AI in Wealth: Content Recommendations

Content Recommendations grow AUM

Updated: May 25, 2020

Artificial Intelligence (AI), has become one of the hottest buzz words in many industries. Using AI to recommend content or products that customers are more likely to buy is a very practical and common application for driving compelling Sales results in many business.

Given today’s need for Advisors to get closer and more engaged with their client, seems like an excellent good time to discuss how to bring this highly successful AI use-case into Wealth Management. Applying an AI powered content recommendation engine to your business can have significant impact on Client engagement and AUM growth.

Proven AI Use-Case : Customer Recommendations as Sales driver

While AI is being explored in a variety of business areas, there is one practical application in market today delivering compelling impact across many consumer and business services. Using AI as a predictive analytics engine which can crunch through mountains of historic customer data, then provide a list of actionable predictions of future customer interests and potential sales opportunities, which marketers can turn into a series of suggestions, messages and offers.

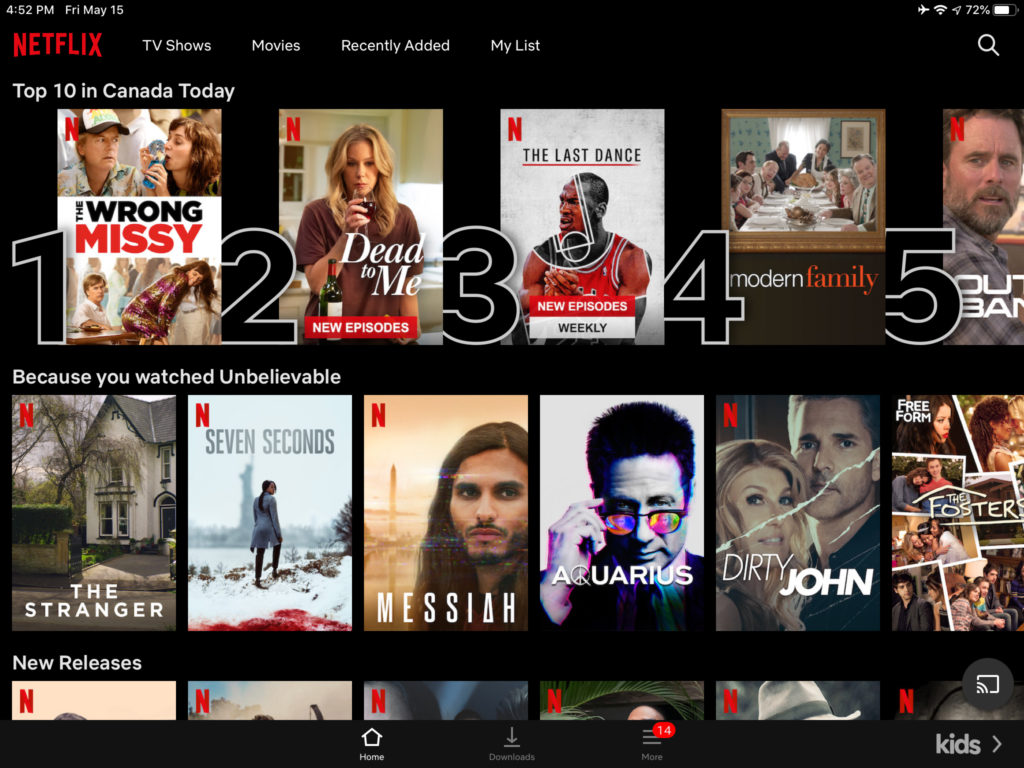

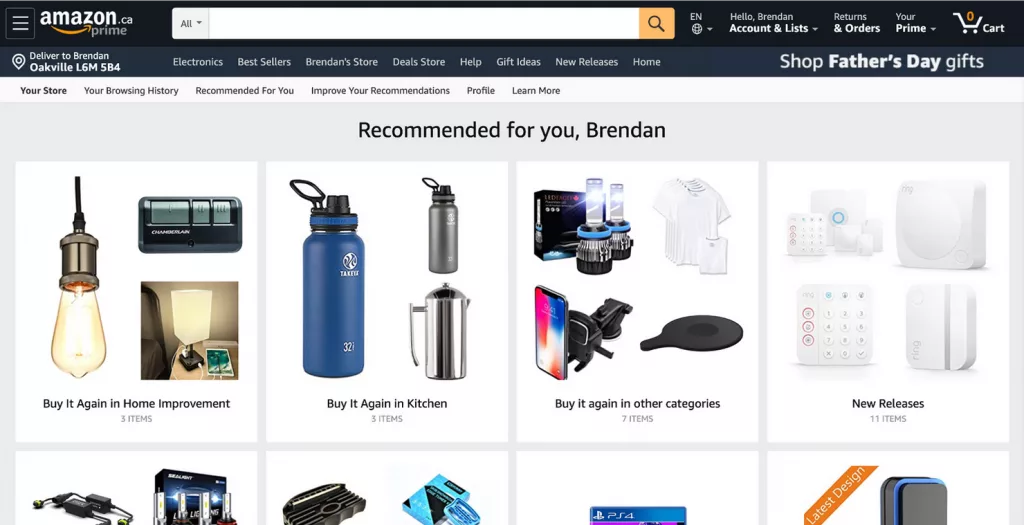

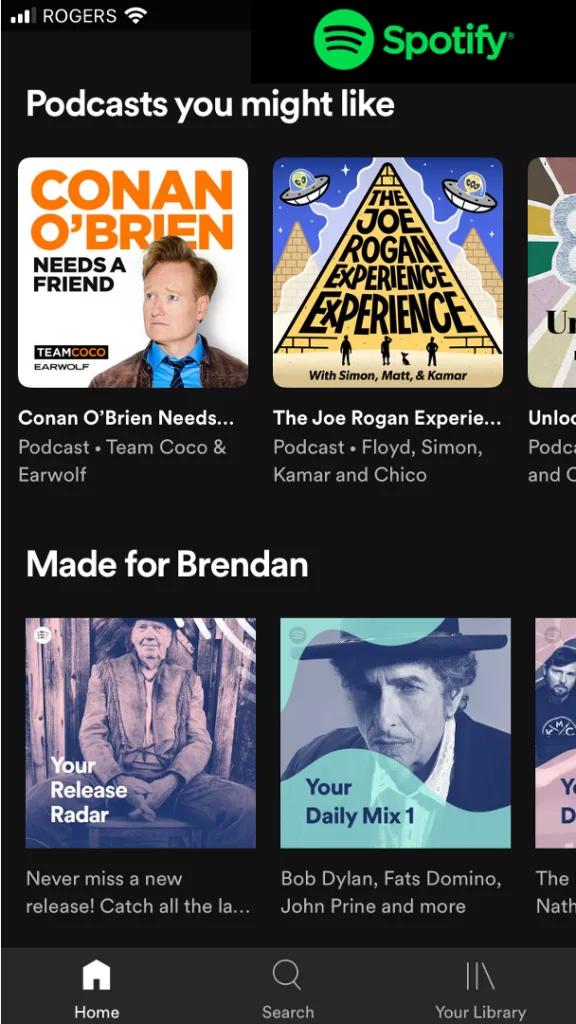

You have likely experienced this tool on ecommerce or digital services like Amazon, Netflix or Spotify. This clever upsell, cross-sell machine can be disguised as “customer recommendation” or “suggested for you”widget, but whatever the name used they are highly effective impacting customer behavior and increasing sales.

Amazon reco engine

What looks like a simple friendly tool to help customers more easily find things they might like, is actually a complex data analytics and predictive engine responsible for generating over 35% of Amazon’s sales through a 3 stage process :

- Analyze customer’s past activities : Review all of the data collected on each customer’s previous activity with the company (email. web browsing, purchasing…)

- Predict Customers future interests & needs : Past behaviour can serve as an excellent indication of future behavior. By running predictive AI models on your customer data combined with other CRM or BI data, you being to build and refine a

- Action that prediction : Once you understand what Customer or client might be interested in your marketing and sales team can start to provide information on the content or products each customer will be more likely to engage with or buy.

AI recommendations Impact : Amazon & Netflix

Customers like relevant recommendations and respond favourably. Recommendations generated by using AI to analyze a customer of client’s past behavior and predict future interests, is now well proven to drive significant business impact across many industries.

For context around how several leaders are using AI powered recommendations to drive sales and support their broader business strategies.

- Amazon : 35% of Amazon’s sales are driven from AI powered Recommendation engine. Engine allows them to funnel customers into products that combine both what buyers wants, but also have higher profit margin for Amazon.

- Netflix : 80% of Netflix content consumption comes from their recommendations, allowing them to funnel users into their own branded content vs content licensed from other providers

- Spotify : Listeners of recommended music have 2X engagement, loyalty and trust, allowing Spotify to further monetize its 200M users by providing opportunity to help artists grow their audiences.

AI opportunity in Wealth : Using AI for Client Content Recommendations

Wealth Management firms now have to opportunity to increase AUM growth by using AI to understand and predict what content to deliver to each client when. Similar to other industries, providing more of the information each client wants will increase engagement, satisfaction, investment appetite and referrals for their Advisor.

The technology now exists for Wealth Management firms to use a similar type of AI powered recommendation engine to enable their home office team to help advisors provide their clients with more of the content they want, when they want it.

Based on our ongoing studies of with customers beginning to implement these programs, we are seeing a 16X increase in Client engagement and content interactions across the enterprise. This result comes from impacting 4 specific areas of the content sharing process between Advisors and their clients :

- What Content is each Client interested in : Knowing what topics & formats of content clients are most interested receiving from their Advisor

- Best frequency, date & time to send : Know at what frequency, time & day of week a client prefers to receive information from their Advisor

- Which subject lines get opened : Understand what types subject lines and key words each client is most likely to respond to

- Simplify Advisor adoption of program : As gatekeeper of all client communications, Advisor participation is key to having successful home office program across the enterprise. As all AI generated recommendations are sent to the Client’s Advisor for acceptance prior to distribution, the Advisor’s understanding, appreciation and trust in value of the AI generated content for their Client’s must be built over time. As Advisors begin to see Client’s positive response and value of program we generally see adoption grow from 10% using do-it-yourself sharing tools to 70-80% sharing AI recommended content using our simple 1-click process to Accept / Reject / Edit.

AI growing success in Wealth : Grapevine6 Example

Grapevine6 is a partner of ours, and is getting terrific interest and adoption of their AI powered Social Selling & Employee Advocacy platform. The platform uses AI to understand what content your specific LinkedIN followers respond best to, then searches +60,000 sources on the web to find and suggest 3rd party articles that best satisfy that need. Platform has full compliance layer, so leading wealth management firms like Raymond James in US and Royal Bank of Canada have been rolling it out to Advisors as part of their social selling & branding initiatives. Results so far have been very impressive as detailed in recent case study with SAP.

It’s an exciting time to be in WealthTech. We look forward to discussing the impact of AI powered content recommendations for clients as growth driver for Wealth Management firms looking for new managed services to help their Advisors grow.

Please let me know if you have any feedback, questions or suggestions around this article.

Brendan Kenalty | CMO

brendan.kenalty@reachstack.com