AI Content Distribution as a Growth Tool

Video : How AI powered Content Distribution is Next Generation growth tool for Wealth Management

Updated: May 9, 2020

The 24/7 digital world has changed your Client’s expectations around communication and proactive outreach. The firms doing the best job leveraging modern 3rd Generation Marketing technology like Data Analytics, AI and Automation are helping their advisors take advantage of this new environment to grow, at the expense of those firms who aren’t.

With competing Advisors & robos actively pursuing your clients everyday, treating them to a phone call a couple of times a year doesn’t cut it anymore. In a recent survey, 91% of Advisors said increasing number of interactions with Clients (email / social) is fundamental to driving growth in today’s environment.

Busy Advisors can’t solve this communication challenge on their own, with 64% indicating they need more Marketing help increasing email & social interactions with clients. To be competitive today, Advisors need the same level of collaboration and support from their home office Marketing team that the leading firms are providing.

This post and video share some of our learnings, insights & roadmap for how AI powered Content Distribution & Client Communication has driven development and adoption of a new 5th Generation of WealthTech tools, some of which are already driving competitive advantage and growth for firms leading the early adoption.

The 5 Generations of Digital Communication & Content Sharing

Working with customers over the last 15 years, we’ve evolved through several generations of approaches to digital client communications, and the associated technology. Each progression has had clear benefits and subsequent challenges. For the purpose of this discussion we’ve bundled them into 3 groups based on marketing approach and required technology platform.

Generation 1/2 : Marketing sends directly to Clients (2008-2013)

The 1st generation of digital communication was focused on home office Marketing teams helping the firm and Advisors by taking care of sending core communications to their clients. This was primarily done using central email programs like Marketo or SalesForce Marketing Cloud, to access central list of all clients then executing a communication and content sharing programs.

Pros :

- Efficient : Marketing can take ownership for planning & execution (save Advisors time)

- Right Skills : Marketing have communication skills & resources (copy & images)

- Compliance : Marketers understand & follow Compliance approval process

Cons :

- Lack of Advisor control : HATE when Marketing engages their clients without approval

- Low List Access : Advisors weren’t providing access to full client & prospect lists

- Low Impact : Low response rates on email from brand limit impact (10-20% open rates)

Generation 3/4 : Marketing gives Advisors Do-it-Yourself tools (2014-2019)

To address the business impact challenges around 1st generation, a wave of Advisor “do-it-yourself” content sharing & communication tools hit the market like itracMarketer, Hearsay, FMG & Snappy Kracken. Advisors understood the importance of leveraging email / social channels to engage clients and drive their business, and Marketing teams were excited to be able to provide Advisors with set of slick self-serve tools to run their own programs in a compliant way.

While this seemed like a terrific solution, low adoption, usage and impact of these tools has frustrated firms who are paying annual license fees for all their Advisors, but only 10% of Advisors actively using them.

Feedback from the 90% of Advisors not using the tools, indicates they understand importance of increasing interactions with clients, but don’t have the time, skills or interest in spending time managing Marketing campaigns that could be done more efficiently & effectively by the home office team.

Pros :

- Active Advisors see Impact : 10% who use tools effectively see impact

- Response Rate : Emails from Advisors get higher engagement (50-80% open rates)

Cons :

- Low Adoption : 90% Advisors don’t use them

- Lack of Enterprise Reporting & Insights : Distributed activities limit overall program view

- Low Impact & ROI : 10% Advisor usage limiting business impact & ROI

Generation 5 : AI & Marketing drive activity, Advisors get control (2020)

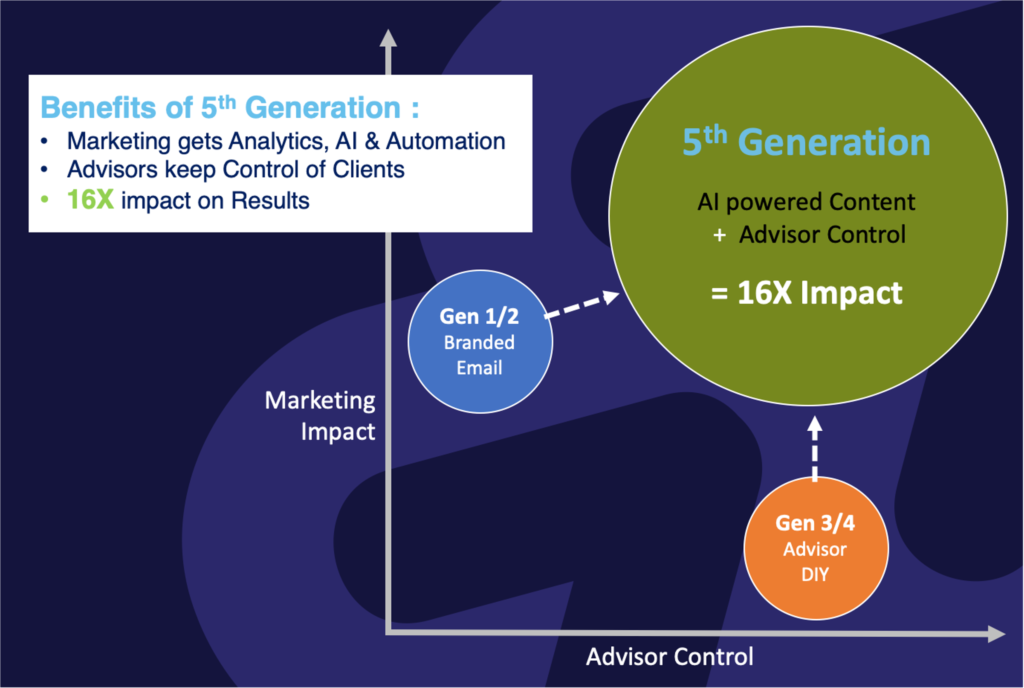

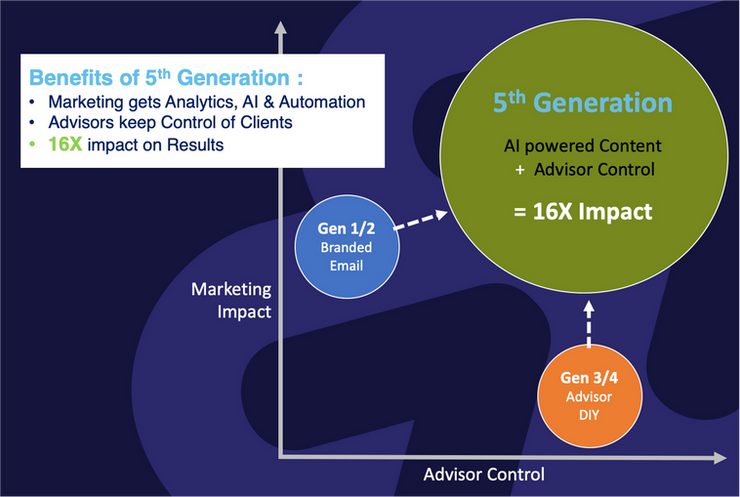

There are 2 advancements in 5th Generation which solve the fundamental challenges with previous generations of tools, resulting in the “best of both worlds” combination and 16X impact for this platform :

- Marketer use of modern technology increases Efficiency & Effectiveness 8X : Content performance insights, predictive AI tools for planning, automated distribution of personalized content to Clients

- Advisor control of Client Experience increases adoption 7X : Marketing drives content sharing between Advisors and their Clients, but each Advisor has simple 1-click approval of ALL outgoing communications

Benefits of AI powered Email and marketing automationby ReachStack

5G Innovation #1 : Marketer use of Modern Technology (8X impact)

As Investment Advisors & firms look for new ways efficiently increase client engagement, modern technology like Data Analytics, AI & Automation have become fundamental tools that allow Wealth Management firms to intelligently automate and scale the frequency and impact of personalized communications between Advisors and their clients.

In a nutshell, AI powered Client Communication & Content Distribution is about using data analysis of historic client email activity data to understand what content each client engaged & responded too, then using AI to predict most effective content plan for each client going forward.

Once you have enough data to model each client’s interests and engagement points, you can begin to action the information thought :

- Enterprise level Content Planning & Investment : Home office Marketing understanding what content to create or source for maximum impact with clients

- Personalized 1-1 content plan for each Advisor / Client : What each advisor should send to each client when for maximum business impact

- Automate communication between Advisors / Clients : Use powerful marketing automation engine to streamline sending most impactful content from each advisor to each client

By leveraging modern tools in the planning, creation & distribution of content sharing we are seeing 8X impact through increased frequency and response rates.

5G Innovation #2 : Advisor Control of Client Experience (7X impact)

There is an age old battle in Wealth Management between the home office and the advisors about who owns the client, and the client experience. At the end of the day, both parties know that best way to drive growth & retention is for clients to be as engaged and satisfied as possible. The most efficient way to accomplish this, is for Advisors and the home office Marketing team to be have simplier way to collaborate on this goal, where firm can leverage the skills and expertise of both groups in do what they do best.

Our 5th Generation platform automates Client communication workflow with 3 distinct roles & responsibilities :

- Home Office Marketing : Use modern tools to plan, produce & initiate digital distribution process (email / social) for outbound content & communication to clients from each Advisor

- Compliance : Review & approve Marketing communications before sending to Advisors

- Advisors : Review, add personal touch and approval all communication for Client distribution

By increasing the simplicity and clarity of roles in the Client Content & Communication collaboration, and frankly making it very easy for advisors to have content prepared for their clients, we see 7X increase in Advisors participation from do-it-yourself.

We look forward to hearing your thoughts and feedback on this topic. Please feel free to reach out on LinkedIn or by email.

Brendan Kenalty | CMO

brendan.kenalty@reachstack.com