Posts by Brendan Kenalty

Three Studies Showing Clients Want More Communication

Research: 3 Studies show Clients want more communication from their Advisor By Brendan Kenalty | MBA | CMO ________ Given the connected, information hungry nature of people of all ages now, we’ve pulled together some rather shocking research on state of Advisor Client communication in 2020: In this report we’ve analyzed 3 recent studies to…

Read MoreVideo: 3 Truths of Modern Client Communication

In Episode #2 of our Feedback from the Field series, we share input from Wealth Management leaders on the Client Communication Revolution, and how Advisors need more help to react. Our CMO Brendan Kenalty shares learnings from conversations with Wealth Management marketing and practice management leaders over last 12 months. Spoiler Alert : Clients have…

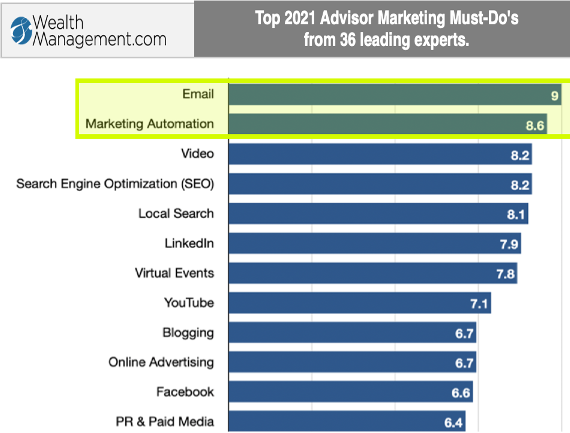

Read MoreWhy Experts Voted Email Best Advisor Growth Tool

3 Reasons Experts Voted Email #1 Advisor Growth Tool for 2021 Updated: Mar 31 The experts have voted. Email is #1 tool for Advisor revenue growth in 2021. In December 2020 WealthManagement.com surveyed 36 marketing leaders to ask what their top “must-do’s” were for Advisor revenue growth in 2021. Email (90%) and Marketing Automation (86%) topped…

Read MoreAI Powered Email: Wealth Management

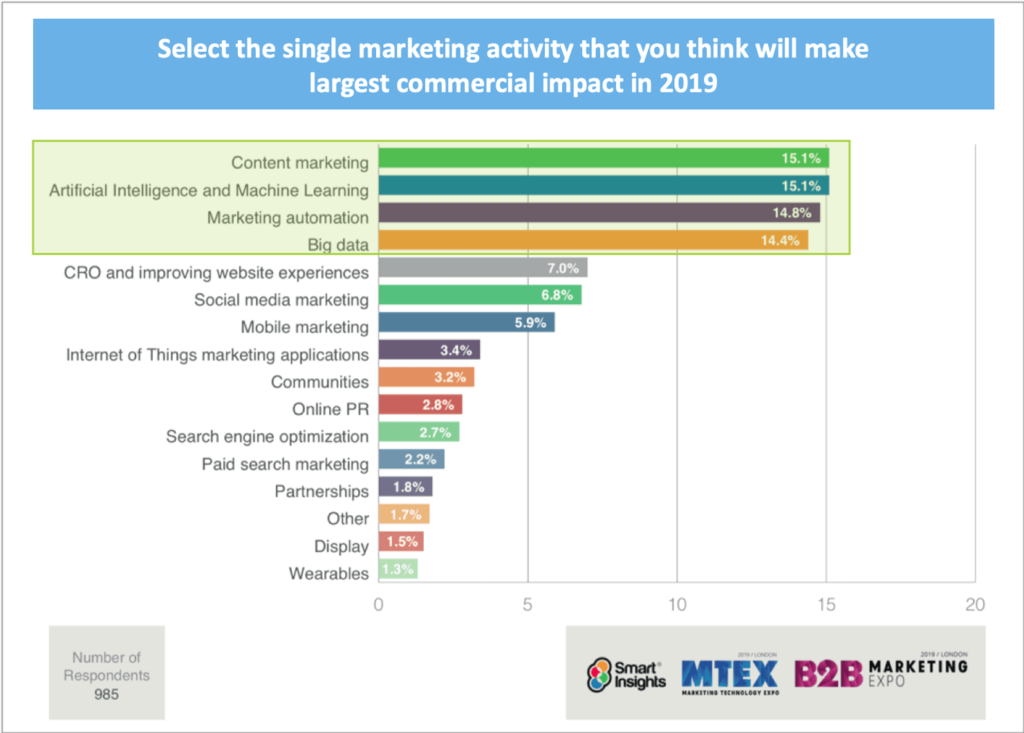

The King is back in Wealth Management. Updated: Sep 21, 2020 Social is a hot topic for marketers, but Email is still the hardest working marketing program and about to get its swagger back in Wealth Marketing. Recents surveys* show the 90% of people in US check their personal email everyday, and even Millennials choose email…

Read MoreNew Report: Clients Prefer More Communication from Advisors

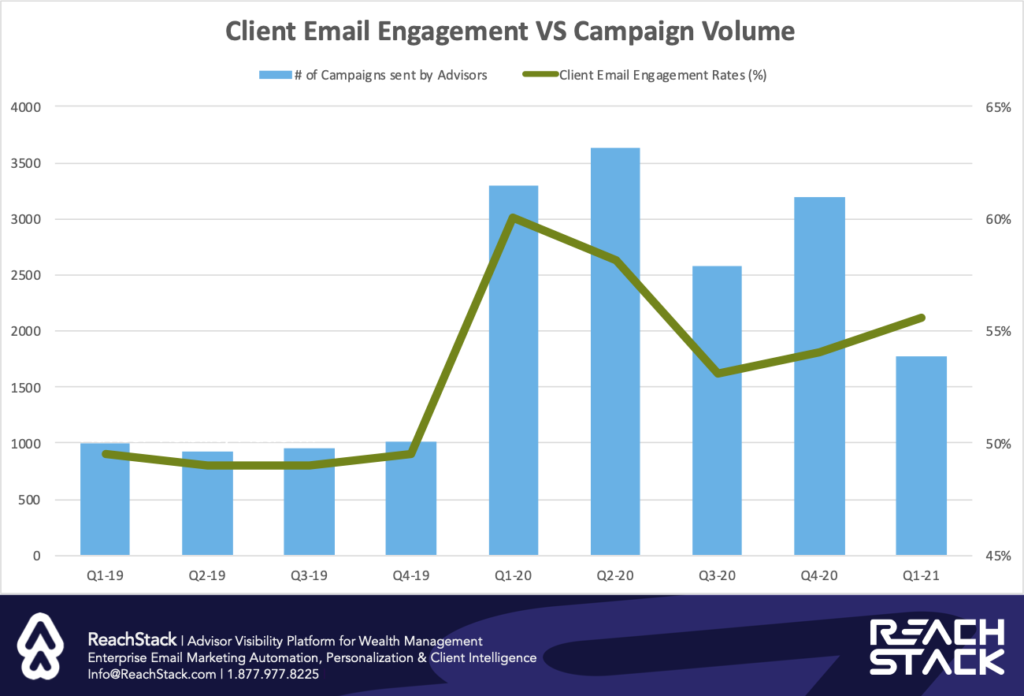

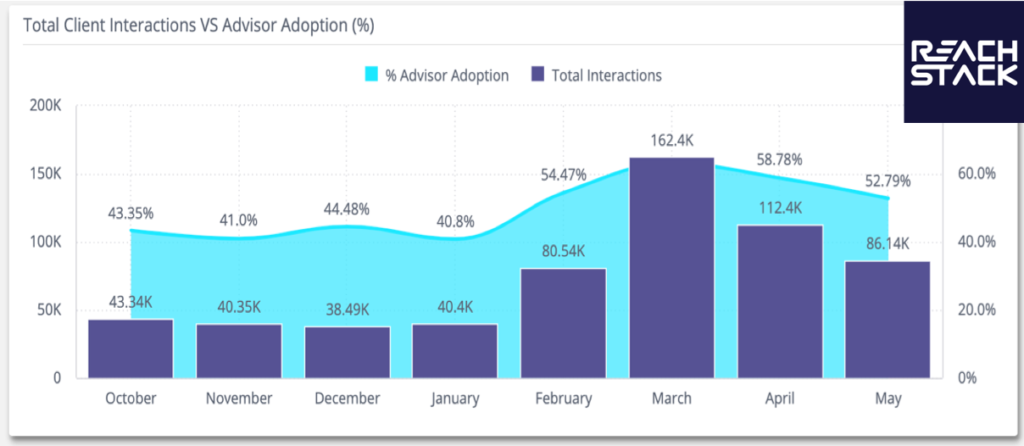

Report: New Data Proves Clients Want More Communication From Advisors Updated: Apr 20 Advisors who double communication frequency with their Clients also experience 20% increase in email engagement levels. TORONTO, ON – ReachStack, one of North America’s leading enterprise level client communication & visibility platforms for wealth management firms and their advisors, has shared a recent…

Read MorePandemic Has Wealth Clients Seeking Advisor Insights

Report: New Data Proves Clients Want More Communication From Advisors Updated: Apr 20 COVID-19 Pandemic Has Wealth Clients Clamoring for Advisors’ Insights TORONTO, ON – ReachStack, North America’s leading content automation platform for wealth management firms and their advisors, has shared findings from an analysis of Client engagement in the wake of the COVID-19 crisis, financial…

Read MoreTech Train Leaving Station for Financial Advisors

Tech Train is Leaving the Station for Financial Advisors All aboard the WealthTech Train. The train is leaving the station for wealth advisors who are looking to boost their AUM in the wake of the COVID crisis. As we recently noted in our white paper “The Wealth Marketing Round Table: Q3 2020 Outlook,” wealthy clients…

Read MoreTop 3 AUM Growth Tactics

Report: 3 Must-Do’s for 2020 AUM growth Updated: Aug 17, 2020 As the health, economic and political chaos continue to dominate Wealth client moods and activities for rest of 2020, we asked a few Wealth Marketing experts to share their priorities, tips and best practices around driving client engagement and AUM growth in today’s climate. Below…

Read MoreReachStack names AI leader New VP Engineering

ReachStack names AI leader new VP Engineering as focus shifts to US Wealth market. ReachStack Names AI Leader Raghavendra Iyer as VP Engineering. Focus shifts to United States Wealth Management Market. TORONTO, CA – ReachStack, North America’s leading content automation platform for wealth management firms and their advisors, has announced the hiring of US data…

Read MoreFirms Help Advisors 2X Interactions Winning AUM

The market crisis has caused tremendous turmoil and stress for Clients, Advisors and their Firms, but also opportunity. With so much money in motion the Advisors who are able to quickly and proactively provide more frequent information, updates and advice to their clients are building loyalty, getting referrals and winning AUM. Clients want more interactions…

Read More