AI Powered Email: Wealth Management

The King is back in Wealth Management.

Updated: Sep 21, 2020

Social is a hot topic for marketers, but Email is still the hardest working marketing program and about to get its swagger back in Wealth Marketing.

Recents surveys* show the 90% of people in US check their personal email everyday, and even Millennials choose email as preferred channel for content around personal finances.

For Dealer Brokers looking for new modern Managed Service to help their advisors grow, AI powered Email with Automation is exciting advancement. By combining email’s 1-1 reach & privacy benefits with modern analytics, AI and automation based on client specific activity data, your home office Marketing team can efficiently increase the frequency & relevancy of content sharing between all Advisors and their clients. More client interactions, mean more growth for Advisors. The King is back.

As Digital marketing has evolved, Email always delivers.

As a long time digital, email and social media marketer for some of the biggest brands, I’ve learned that change is the one constant in the Digital space. To effectively deliver ongoing results you must keep up with future trends & technology, then embrace it and become an expert on what catches on in market.

For 20 years email has reigned supreme as the undisputed #1 most efficient & effective digital marketing tactic to drive business growth. With 90% of Americans checking their email everyday, 82% of marketers recently confirmed that Email still has highest ROI of any digital tactic*. By owning a database of clients & prospects, it is easy and cost efficient to literally generate results at the push of a button.

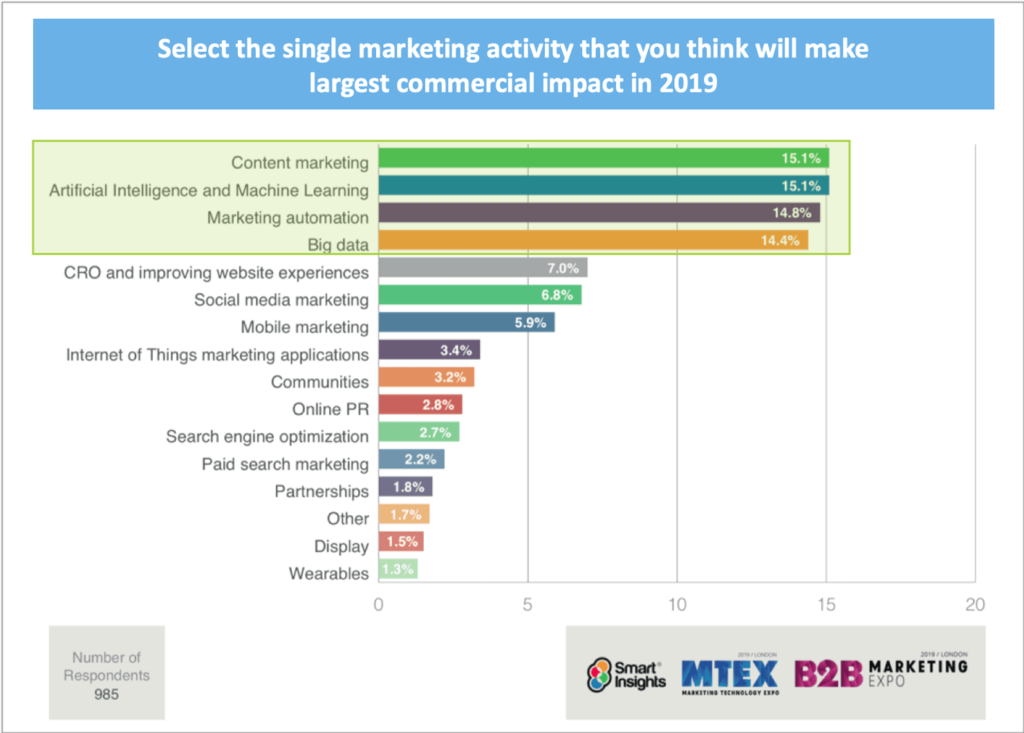

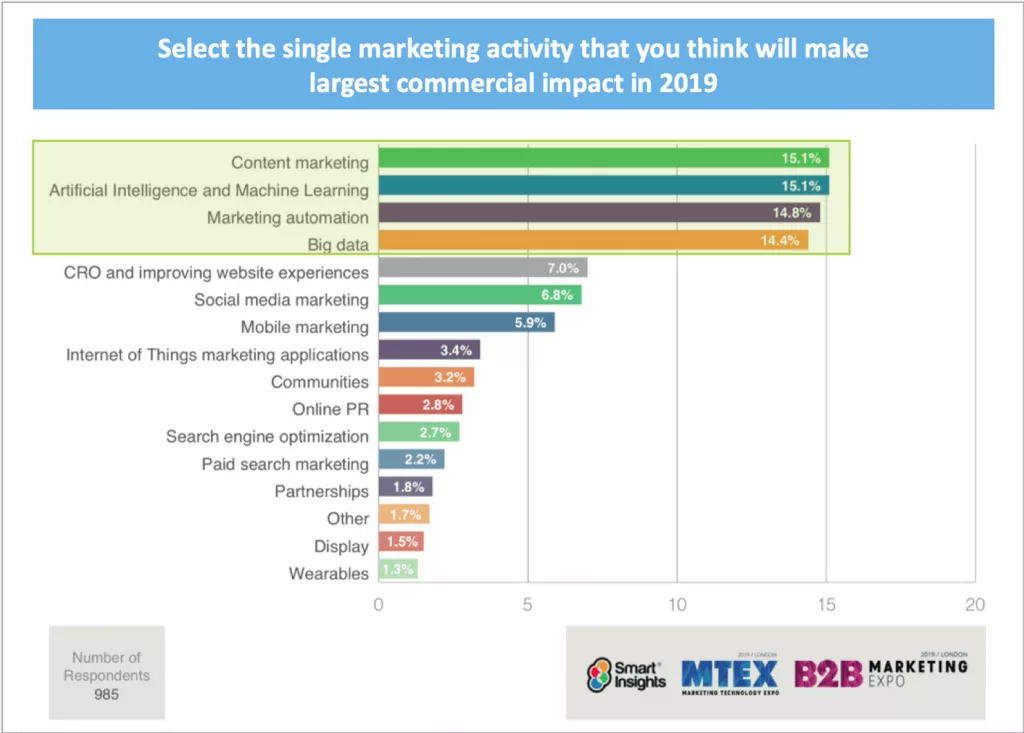

As Social Marketing, Content Marketing, SEM and SEO have grown in popularity, Email has continued to be the hardest worker, while also achieving the coveted status of boring utility. Well that’s about to change.

Data Driven marketing top priority for Wealth Marketing.

The hottest topic in Wealth Management marketing is the collection, analysis and application of client data for firm and Advisor growth.

A recent survey of marketing leaders at US Wealth Management firms show top 4 priorities focus on using client activity data to understand, predict and deliver personalized client experiences which drive increased AUM growth for Advisors and the firm.

AI powered Email uses Client data to deliver personalized experiences.

Fun fact. Did you know that most firms (and businesses) use a client’s email address as primary identifier to connect their records across all databases and Salesforce tools. This means that all the data and insight about each client across an entire enterprise is connected to their email addresses.

Now think about what that means as marketer trying to provide personalized experiences to clients. For each email address (client), we have a wealth of data to feed into an AI engine, allowing us to predict WHAT content experience, to send to WHICH clients WHEN, to drive maximum interest and business impact.

The unique power of email platform (vs a social tool), is that we can also track each client’s unique response to all outbound content & communications, and put that data back into the AI engine to predict the next thing we should send them. We can also provide a view of that client’s interests and activity to their Advisor to help them understand what a client may be interested in for followup call or meeting.

Enterprise level CMO dashboard

Collecting data at client and advisor level, gives us the ability to roll it up to enterprise dashboard view at CMO level. By analyzing overall program performance at enterprise level, we can understand and what operation elements are working the best, and provide detailed understanding to the Content Marketing team about what content topics, messaging, authors, formats and other parameters are generating highest impact with clients.

Success Tip : Advisor approval of ALL outbound communication is vital

An important note for success. While AI powered Email is generated by home office based on client data analysis, then automated for efficient delivery at scale, for an Email communication program to be successful at a Wealth Management firm, each Advisor MUST get opportunity to review and approve any email PRIOR to being sent to their clients.

There needs to be a simple process for an Advisor to be notified, review and approve outbound communications and content, but with minimal delay to clients receiving information in a timely manner. For instance, we use a simple process for Advisors where they receive an email showing what will be sent to who. With 1-click the Advisor selects Send, Stop, or Edit. Adding this step in the process has allowed firms we work with to increase Advisor participation and support of the program by 7X.

Summary : AI powered Email is terrific managed service for Advisor growth

Only email has :

- Flexibility : Integrate with any Content library (or RSS feed) to turn AI insights into personalized, private, high impact content experience

- Scale & Reach : Efficiently deliver the content directly to every client for your Advisors

- Performance Data at Client level : collect the response data for each client and feed it back into the machine

The King is indeed back. Long may he reign.

Please let me know if you have any feedback, questions or suggestions around this article.

Brendan Kenalty | CMO

brendan.kenalty@reachstack.com