Advisor Communication Resource Blog

Ideas, tips and best practices to help Financial Advisors better use Client communication as growth tool.

- All

- AUM Growth

- Client Retention

- Crisis Control

- Done4U Marketing

- Financial Edcuation

- Financial Education

- Integrations

- Platform News

- Press Release

- Sales Intelligence

Financial Literacy is the new prospecting qualifier for Advisors.

| By Brendan Kenalty | AUM Growth, Client Retention, Financial Edcuation, Financial Education, Brendan Kenalty , Financial Literacy

Advisors who use Financial Literacy as way to qualify prospects & identify which clients to focus on see significant business impact. By Brendan Kenalty.

Fresh Finance ReachStack partnership now provides more Intelligent, Efficient and Impactful Communication for Financial Advisors.

| By Brendan Kenalty | Done4U Marketing, Press Release, Sales Intelligence, Brendan Kenalty , Financial Advisor Communication

Press Release - Fresh Finance & ReachStack partner to add new analytics, AI & intelligence into communication service for Wealth Managers.

How to use Financial Education to build Math skills and Client relationships.

| By Brendan Kenalty | AUM Growth, Client Retention, Financial Edcuation, Financial Education, Brendan Kenalty , Financial Literacy

By providing Financial Education as a service for their Client's families, Advisors are turning generational Wealth Transfer from a risk into a growth opportunity. By Brendan Kenalty.

Financial Education – How Advisors win the great Wealth Transfer.

| By Brendan Kenalty | AUM Growth, Client Retention, Financial Edcuation, Financial Education, Financial Literacy

By providing Financial Education as a service for their Client's families, Advisors are turning generational Wealth Transfer from a risk into a growth opportunity. By Brendan Kenalty.

Unleash the Impact of Financial Literacy: See the Value of Teaching Personal Finance & Investing at an Early Age

| By Brendan Kenalty | AUM Growth, Client Retention, Financial Edcuation, Financial Literacy

Teaching Personal Finance & Investing at an early age has tremendous benefit for individuals. See the impact Financial Education can have. By Brendan Kenalty.

Unlocking Wealth: 4 Ways Financial Literacy Drives Personal Net Worth

| By Brendan Kenalty | AUM Growth, Client Retention, Financial Literacy

See 4 practical examples of how increasing an individual's Financial IQ directly impacts their Net Worth. By Brendan Kenalty.

The Power of Financial Literacy: Enhancing Client Value for Wealth Management Firms.

| By Brendan Kenalty | AUM Growth, Client Retention, Financial Literacy

Here are 4 practical examples of how increasing each client's Financial Literacy creates value for Financial Advisors. By Brendan Kenalty.

News Release: ReachStack launches AI powered Sales Intelligence for Wealth Management

| By Brendan Kenalty | AUM Growth, Done4U Marketing, Platform News, Press Release, Sales Intelligence, Brendan Kenalty , Sales Intelligence

News Release: ReachStack launches AI powered Sales Intelligence fas AUM growth tool for Wealth Management firms

3 ways Advisors are using ChatGPT to make Client communication easy and efficient.

| By Brendan Kenalty | Client Retention, Done4U Marketing, Platform News, Financial Advisor Communication

See 3 ways Financial Advisors are now using ChatGPT to make Client communication easier, efficient and impactful. By Brendan Kenalty.

Financial Advisor Client communication has big impact new studies show.

| By Brendan Kenalty | AUM Growth, Client Retention, Sales Intelligence, Financial Advisor Communication , Smart Asset , YCharts

A must read for Financial Advisors. See 4 key takeaways from new studies by YCharts and Smart Asset on impact of Client communication in Wealth Management. It turns out communication has BIG impact on a Financial Advisor's business.

Client Data Is Now Prospecting Gold For Advisors.

| By Brendan Kenalty | AUM Growth, Platform News, Advisor prospecting efficiency , Sales Intelligence

Financial Advisors who have more relevant information about prospect needs and interests are winning new clients faster and more efficiently. They know what products & services people are interested in, then use this information to educate, reassure and nurture Client relationships. Find out more.

Bill Good Marketing selects ReachStack to power new Done4U Advisor Digital Services.

| By Brendan Kenalty | Done4U Marketing, Press Release

Bill Good Marketing has selected ReachStack as their technology partner, for a suite of next generation Digital Growth and Communication Services built for their Financial Advisor customers.

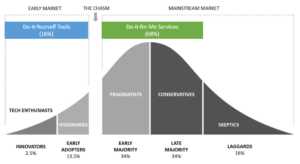

Financial Advisors Rejoice As Digital Shifts To Done-for-Me Service.

| By Brendan Kenalty | AUM Growth, Done4U Marketing

80% of Financial Advisors are set to rejoice, as Digital Marketing shifts from Do-it-Yourself to Done-for-Me service in 2023.

Webinar: Add ReachStack to your Wealthbox CRM and grow Revenue faster

| By Brendan Kenalty | AUM Growth, Integrations, Wealthbox

Join us for this live webinar to discover how to sync contacts from Wealthbox to ReachStack for automated content sharing, revenue nurturing and interest tracking.

Top 3 Themes From 2022 Wealth Management Edge Conference.

| By Brendan Kenalty | AUM Growth, Integrations

After attending 2022 Wealth Management Edge conference we're excited to report that speakers mentioned same 3 topics, exactly is ReachStack built to impact.

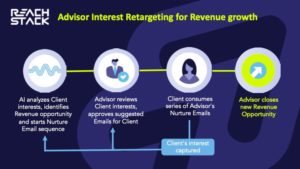

Interest based Revenue nurturing for FA’s. Like web retargeting but better.

| By Brendan Kenalty | AUM Growth, Integrations

Retargeting web visitors with ads based on product interest delivers 43% increase in Sales conversion. Retargeting Wealth clients with personalized emails from their Advisor based on product interest, builds demand and grows Revenue.

5 Steps To Choose Best Email Solution For Your Wealth Firm’s Financial Advisors

| By Brendan Kenalty | AUM Growth, Integrations, Platform News

Evaluating new technology can be challenging and time consuming, so we put together a simple 5 step evaluation process for selecting best Advisor Email and Client communication for your firm.

Raising America’s Financial IQ will grow our Wealth Industry, so let’s give FAs a free AI powered service that makes it easier to educate clients

| By Brendan Kenalty | AUM Growth, Client Retention, Integrations

Imagine the revenue impact for Wealth Management industry of having every American more knowledgeable about their financial situation, and increasing their level of participation.

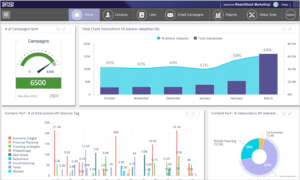

ReachStack + Salesforce Make It Easy To Identify & Nurture New Revenue

| By Brendan Kenalty | Integrations, Platform News, Press Release

ReachStack announces that their Email and Contact Interest Tracking tools are now available right from a users SalesForce dashboard.

MD Financial selects ReachStack for personalized Content Marketing

| By Brendan Kenalty | Press Release

ReachStack has been selected by MD Financial to enable the next generation of personalized client communication, engagement & growth initiatives.

Adding Human layer to your Digital Experience can deliver 300% increase

| By Brendan Kenalty | Platform News

“People buy from people they like”, is a fundamental truth in business. As humans we’ve arrived at an interesting point in the evolution of digital customer experiences. The rise of sophisticated e-commerce has addicted us to the speed & efficiency of a terrific digital transaction, but people have realized something is missing from that pure…

How Apple’s New Privacy Protection Impacts Advisor Email Marketing

| By Brendan Kenalty | Platform News

Email is the most popular, flexible and mature method of digital communication. Email is a core part of digital marketing activities in most Wealth Management businesses, so Apple’s recent changes to how emails are read and tracked is causing some concerns in marketing circles. In this post we’ll explain how the changes Apple made to…

Book Review: 5 Stars for Ascendant Advisor

| By Brendan Kenalty | AUM Growth, Client Retention

Book Review: 5 stars for The Ascendant Advisor, an actionable Content Marketing playbook for Wealth Reprint of Linkedin article by Brendan Kenalty 5 stars for The Ascendant Advisor. A light, but extremely actionable Content Marketing playbook for Wealth Advisors. Rating = ★★★★★ for The Ascendent Advisor Over the summer, I read a terrific new book…

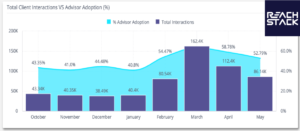

ReachStack grows AUM through 16X increase in Advisor Client interactions.

| By Brendan Kenalty | AUM Growth, Client Retention

ReachStack helps Finance Advisors grow AUM Recent feedback from Financial Advisors & Wealth Managers highlighted 3 things : 100% of Clients (and now Regulators) want to see more value for fees 91% of Advisors say increasing # of Client interactions drives AUM growth & retention 64% of Advisors want more help from Marketing to drive…

5 Steps to Social Media Success for Financial Advisors

| By Brendan Kenalty | Client Retention, Platform News

When it comes to finding ways to increase client engagement and growth, financial advisors don’t need more tools – we need to help them find easier ways to use the tools they have more effectively. Social media is a great example of this. “What we have today is so under-utilized. CRM and the other sources…

The Future of Advice is Female

| By Brendan Kenalty | Client Retention

Meeting the Evolving Needs of Female HNW Investors Women are a growing economic force in the world, controlling one-third of all wealth. Yet many wealth management firms and the industry as a whole continue to misunderstand the needs of women investors leaving them underserved. In this article, we will review some of the research on…

10 PodCast Episodes to Help Advisors

| By Brendan Kenalty | AUM Growth

10 Podcast Episodes to help Advisors Increase Impact of their Client Communications Updated: Jul 27 Staying up-to-date on the latest trends is both challenging and essential for financial advisors. A growing number of podcasts are targeting advisors and helping them to stay current on a wide range of practice management and advisor-client relationship topics, while learning…

Improving Financial Advisors Client Interest Understanding & Action

| By Brendan Kenalty | Platform News

Why Financial Advisors Need to Better Understand and Act on their Client’s Interests Clients are changing and so are their needs. For financial advisors and advisory firms, this means rethinking how you segment and communicate with your clients and prospects. Segmenting clients by assets and/or demographics can be a useful tool, writes April Rudin (LinkedIn/Twitter)…

How Wealth Firms drive Tech Adoption

| By Brendan Kenalty | Done4U Marketing

Wealth Advisory firms are exploring Do-it-for-Me Services as way to finally “cross the chasm” with Advisor technology adoption by Shifting from Do-it-Yourself Tools to Do-it-for-Me Services. Home Depot has spent years built an army of Do-it-Yourself (DIY) home owners empowered with the information and tools to take on almost any project. It’s terrific. Survey’s show…

How Financial Advisors Get More Visibility, Engagement by Sharing the Right Mix of Content

| By Brendan Kenalty | AUM Growth, Client Retention

By Jay Palter Financial Advisors can get more Client visibility & engagement on their content investments, by sharing the right mix of curated and branded information. Sharing knowledge and information is a vital part of how we advance our society. Throughout human history, people have shared ideas, stories and opinions as a way of adapting…

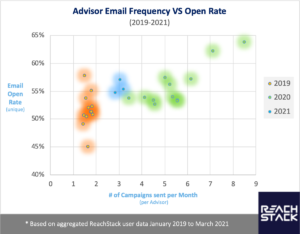

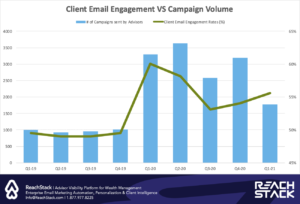

Advisors Who Send More Emails To Clients Get More Engagement.

| By Brendan Kenalty | Client Retention, Platform News

Engaging Financial Advisors The frequency of advisor-client communications is rising – and this is good news. New data analysis shows that increasing the frequency of emails sent by advisors actually increases the clients’ open-rate of those messages by almost 20 percent. ReachStack compiled and analyzed the data from our platform going back over the past…

Winning Advisors Embrace 3 New Communication Habits

| By Brendan Kenalty | Client Retention

Winning Advisors Embrace 3 New Client Communication Habits The widespread adoption of the internet, mobile phones and social media has drastically changed communication habits for people of all ages. This evolution is having a growing impact on Client’s expectations for type and frequency of interactions with their Wealth Advisors and Financial Planners. Today’s winning advisors…

Three Studies Showing Clients Want More Communication

| By Brendan Kenalty | AUM Growth, Client Retention, Brendan Kenalty , Financial Advisor Communication , Michael Kitces , YCharts

Research: 3 Studies show Clients want more communication from their Advisor By Brendan Kenalty | MBA | CMO ________ Given the connected, information hungry nature of people of all ages now, we’ve pulled together some rather shocking research on state of Advisor Client communication in 2020: In this report we’ve analyzed 3 recent studies to…

Video: 3 Truths of Modern Client Communication

| By Brendan Kenalty | Client Retention

In Episode #2 of our Feedback from the Field series, we share input from Wealth Management leaders on the Client Communication Revolution, and how Advisors need more help to react. Our CMO Brendan Kenalty shares learnings from conversations with Wealth Management marketing and practice management leaders over last 12 months. Spoiler Alert : Clients have…

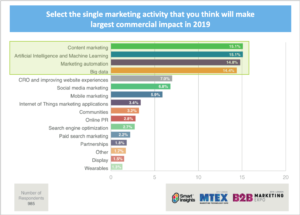

Why Experts Voted Email Best Advisor Growth Tool

| By Brendan Kenalty | AUM Growth

3 Reasons Experts Voted Email #1 Advisor Growth Tool for 2021 Updated: Mar 31 The experts have voted. Email is #1 tool for Advisor revenue growth in 2021. In December 2020 WealthManagement.com surveyed 36 marketing leaders to ask what their top “must-do’s” were for Advisor revenue growth in 2021. Email (90%) and Marketing Automation (86%) topped…

AI Powered Email: Wealth Management

| By Brendan Kenalty | AUM Growth

The King is back in Wealth Management. Updated: Sep 21, 2020 Social is a hot topic for marketers, but Email is still the hardest working marketing program and about to get its swagger back in Wealth Marketing. Recents surveys* show the 90% of people in US check their personal email everyday, and even Millennials choose email…

New Report: Clients Prefer More Communication from Advisors

| By Brendan Kenalty | Platform News

Report: New Data Proves Clients Want More Communication From Advisors Updated: Apr 20 Advisors who double communication frequency with their Clients also experience 20% increase in email engagement levels. TORONTO, ON – ReachStack, one of North America’s leading enterprise level client communication & visibility platforms for wealth management firms and their advisors, has shared a recent…

Pandemic Has Wealth Clients Seeking Advisor Insights

| By Brendan Kenalty | Platform News

Report: New Data Proves Clients Want More Communication From Advisors Updated: Apr 20 COVID-19 Pandemic Has Wealth Clients Clamoring for Advisors’ Insights TORONTO, ON – ReachStack, North America’s leading content automation platform for wealth management firms and their advisors, has shared findings from an analysis of Client engagement in the wake of the COVID-19 crisis, financial…

Tech Train Leaving Station for Financial Advisors

| By Brendan Kenalty | AUM Growth, Client Retention

Tech Train is Leaving the Station for Financial Advisors All aboard the WealthTech Train. The train is leaving the station for wealth advisors who are looking to boost their AUM in the wake of the COVID crisis. As we recently noted in our white paper “The Wealth Marketing Round Table: Q3 2020 Outlook,” wealthy clients…

Top 3 AUM Growth Tactics

| By Brendan Kenalty | AUM Growth, Client Retention

Report: 3 Must-Do’s for 2020 AUM growth Updated: Aug 17, 2020 As the health, economic and political chaos continue to dominate Wealth client moods and activities for rest of 2020, we asked a few Wealth Marketing experts to share their priorities, tips and best practices around driving client engagement and AUM growth in today’s climate. Below…

ReachStack names AI leader New VP Engineering

| By Brendan Kenalty | Platform News

ReachStack names AI leader new VP Engineering as focus shifts to US Wealth market. ReachStack Names AI Leader Raghavendra Iyer as VP Engineering. Focus shifts to United States Wealth Management Market. TORONTO, CA – ReachStack, North America’s leading content automation platform for wealth management firms and their advisors, has announced the hiring of US data…

Firms Help Advisors 2X Interactions Winning AUM

| By Brendan Kenalty | AUM Growth, Client Retention

The market crisis has caused tremendous turmoil and stress for Clients, Advisors and their Firms, but also opportunity. With so much money in motion the Advisors who are able to quickly and proactively provide more frequent information, updates and advice to their clients are building loyalty, getting referrals and winning AUM. Clients want more interactions…

Covid 19 Best Practice: How Firms 2X Client Engagement

| By Brendan Kenalty | Platform News

COVID-19 Best Practice : How firms 2X Client Engagement The COVID-19 crisis has caused tremendous turmoil and stress for Clients, but also for their Advisors who’ve been swamped with requests for more frequent information, updates and advice. Money is in motion, and Advisors know they need to quickly increase the quality & frequency of interactions…

Client Engagement Savings: Give Advisors 5 Hours per Week

| By Brendan Kenalty | Platform News

Client Engagement Savings : Give Advisors 5 hrs a week Updated: Jun 4, 2020 Covid-19 has put a lot of Money in Motion. Help your Advisors free up the time to take advantage of this opportunity to build new relationships, showcase their knowledge and win new clients. Give your advisors +200 hrs a year for Client…

Turning Crisis Into Opportunity with Advisor Communication

| By Brendan Kenalty | Crisis Control, Platform News

Video : How Advisors turn Crisis into Opportunity (6 Tips from McKinsey Wealth) Updated: May 27, 2020 Thanks to Randy Bullard (VP @ Charles River, a State Street Company), for his great LinkedIn post last week. It again highlighted to me that throughout history, a crisis like Covid-19 puts Money in Motion. While some Financial Advisors…

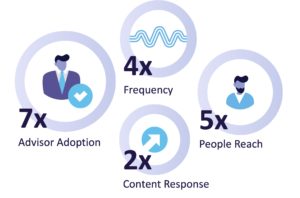

Success Story: 7x Advisor Activation Drives Growth

| By Brendan Kenalty | AUM Growth, Client Retention

Success Video : 7X Advisor Activation drives AUM growth Updated: May 27, 2020 Covid-19 has put Money is in Motion. The result is AUM growth opportunity for firms who scale each Advisor’s activity to engage, reassure & demonstrate value to each of their clients. Leading firms are embracing our new technology to quickly 7X Advisor activity…

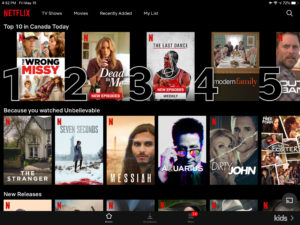

AI in Wealth: Content Recommendations

| By Brendan Kenalty | AUM Growth

Content Recommendations grow AUM Updated: May 25, 2020 Artificial Intelligence (AI), has become one of the hottest buzz words in many industries. Using AI to recommend content or products that customers are more likely to buy is a very practical and common application for driving compelling Sales results in many business. Given today’s need for Advisors…

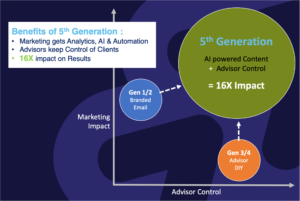

AI Content Distribution as a Growth Tool

| By Brendan Kenalty | AUM Growth, Client Retention

Video : How AI powered Content Distribution is Next Generation growth tool for Wealth Management Updated: May 9, 2020 The 24/7 digital world has changed your Client’s expectations around communication and proactive outreach. The firms doing the best job leveraging modern 3rd Generation Marketing technology like Data Analytics, AI and Automation are helping their advisors take…

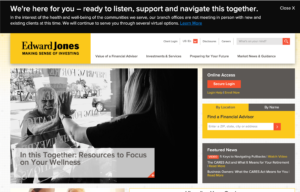

Crisis Messaging Best Practice

| By Brendan Kenalty | Crisis Control

Edwards Jones Example – Crisis Messaging Best Practice Updated: May 27, 2020 We wanted to share Edwards Jones notice as terrific example of effective messaging to clients during this Covid19 crisis. The messaging crafted for their home page notice is bang on the advice & guidance experts like Jim Speros have shared with us. Show you…

Evolving Advisor Digital Marketing

| By Brendan Kenalty | Done4U Marketing

Evolve your Advisor Digital Marketing : Help 90% who can’t do DIY Updated: May 2, 2020 If you are like most Wealth Management firms, the top 10% of your Advisors are rockstars who follow every best practice, use every tool and program you provide, and have embraced Digital Marketing to grow their business. Now let’s talk…

Wealth Management Through A Crisis

| By Brendan Kenalty | Crisis Control

The King is back in Wealth Management. Sharing our Learning’s – Wealth Marketing through a Crisis Updated: May 2, 2020 Our Sales & Marketing team is in the fortunate position of spending most of our time talking to, and learning from some of smartest Marketing and Sales leaders in Wealth Management industry. In a small effort…

Marketing Through A Crisis

| By Brendan Kenalty | Crisis Control

Marketing through Crisis : 3 tips to quickly reach, calm and help your Clients Updated: May 2, 2020 We hope you are staying safe and productive during these challenging times. To help you build your marketing plan for next few months, we wanted to share some advice and Wealth Management marketing best practices from Jim Speros,…

Success Stories: Marketing Advisor AUM Impact

| By Brendan Kenalty | AUM Growth, Done4U Marketing

Success Story : Marketing | Advisor collaboration drives AUM impact ReachStack is an innovative new Content Distribution & Intelligence Platform which enables your Marketing team to help your Advisors share relevant content with their clients more easily and frequently. By delivering a steady stream of strategic high value information, Advisors are able to increase the number…