Financial Advisor Client communication has big impact new studies show.

Last month two new studies were published on the current state of Financial Advisor Client communication in the Wealth Management industry and the impact is has on growing a practice.

By Brendan Kenalty | MBA | CMO

———-

This post highlights four key takeaways from the Impact of Advisor Communication studies published by Ycharts and Smart Assets in December 2022.

Takeaway #1 – Financial Advisor Client communication has big impact on their business.

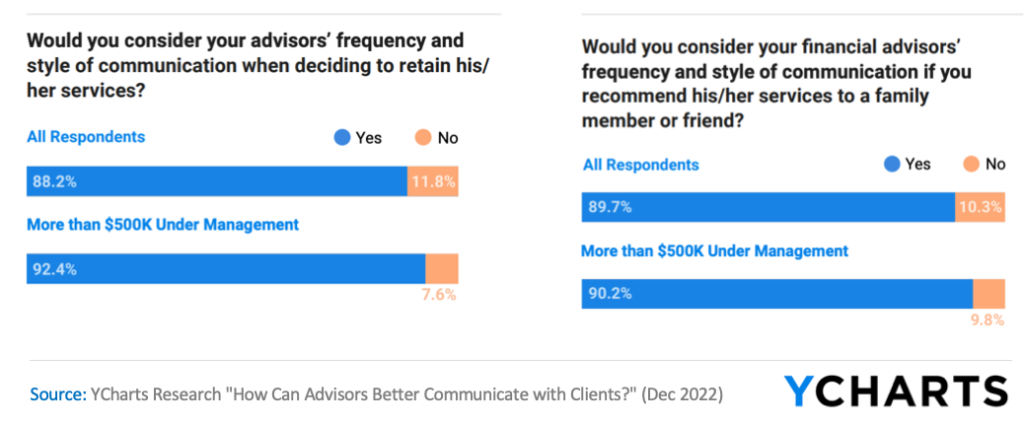

Communication matters to Clients, and Advisors who satisfy this expectation are winning new business. 9 out of 10 Clients say frequency of Advisor communication and information sharing plays a big role in their likeness to stay with them and make a referral. This number has actually increased since 2019, reinforcing communication’s growing importance.

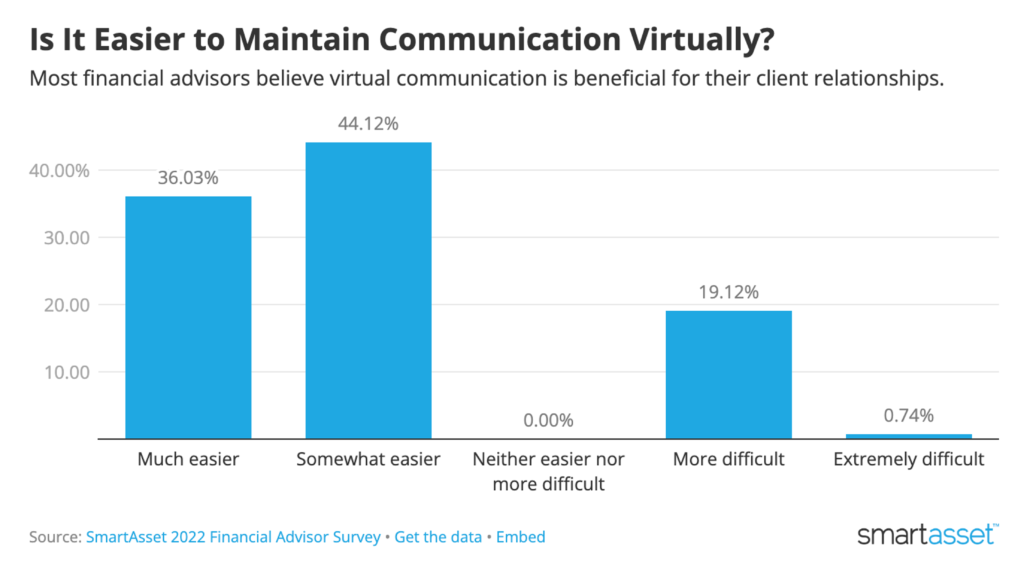

Advisors surveyed also found that using digital and virtual channel to maintain and build prospect / client relationships made it much easier to increase frequency of interaction.

Takeaway #2 – Advisors are making terrific progress increasing communication with Clients and Prospects.

First the good news. We are making terrific progress increasing the level of Advisor communication frequency to meet modern client expectations, led by adoption of new efficient email and digital marketing tools.

Some data from 2 recent studies by Ycharts and Smart Assets:

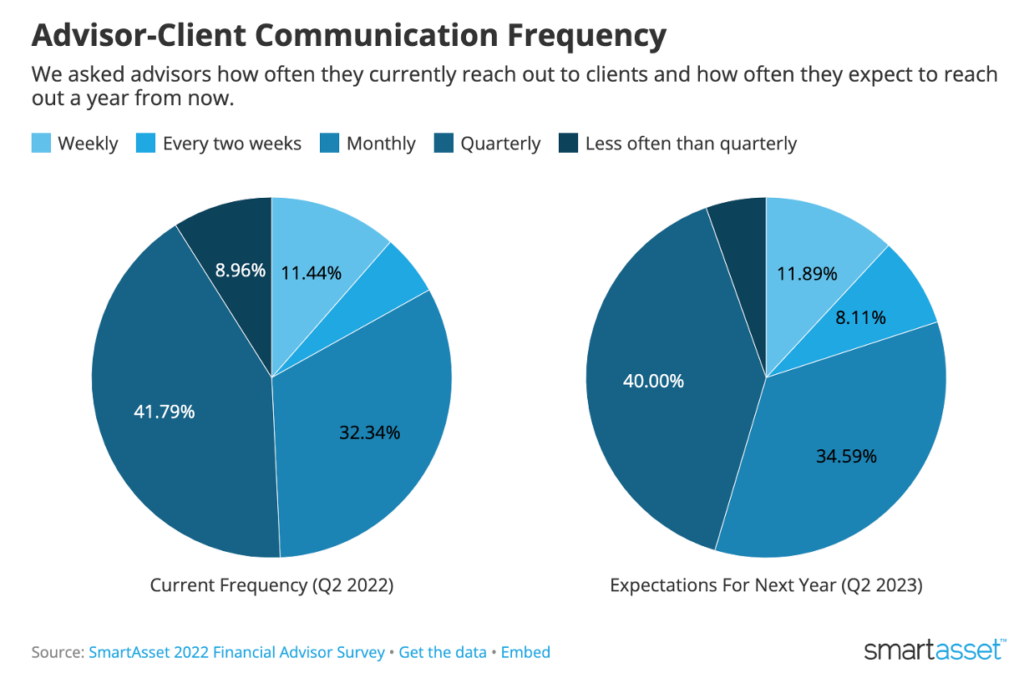

- 33% of Advisors touched base with clients more frequently in 2022 than 2021

- 55% of Advisors plan to communicate more then monthly in 2023 (up 10% from 2022)

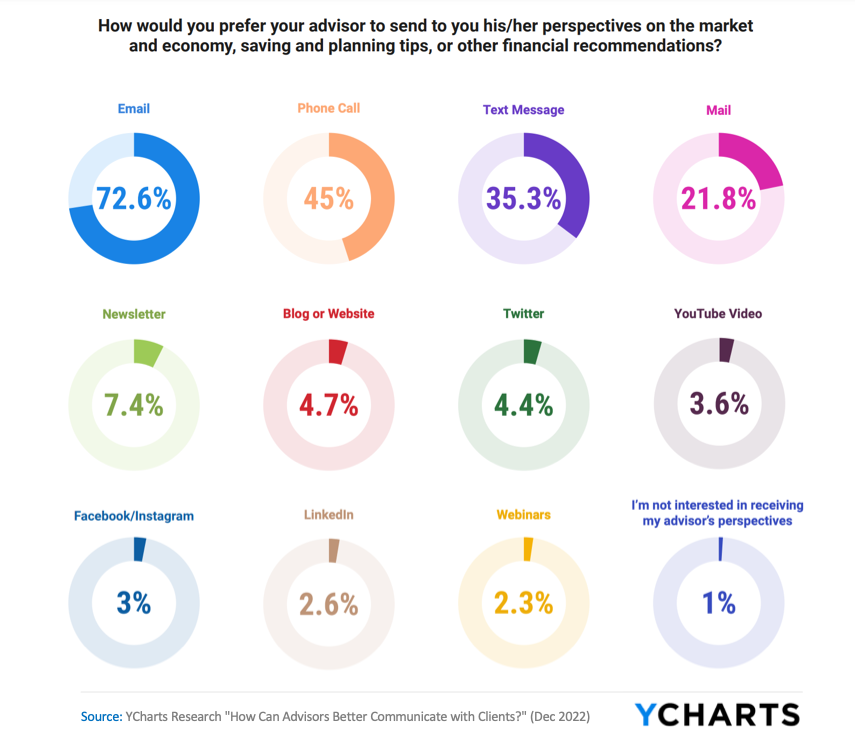

- 73% of Clients want updates from advisor via Email (up 8% from 2019)

- 31% of Advisors say Email is now core channel for Client communication

A couple of charts to that illustrate the progress being made.

Takeaway #3 – Despite the progress, Clients still demand more communication from their Financial Advisor.

So now the bad news. Despite the effort and progress Advisors are making increasing the frequency and value of information they are sharing, we are still not meeting the expectations of today’s modern and connected clients and prospects.

Times have changed. Today’s client and prospects are hardwired into the internet, receiving a constant stream of real time information and advice.

Advisors can’t expect to be the sole source of financial information, but they need to be active and present in the feed. Recent studies reinforce that Advisors who breakout of the traditional “couple of times a year” communication approach with Clients, not only differentiate themselves, but improve client satisfaction and growth through referrals.

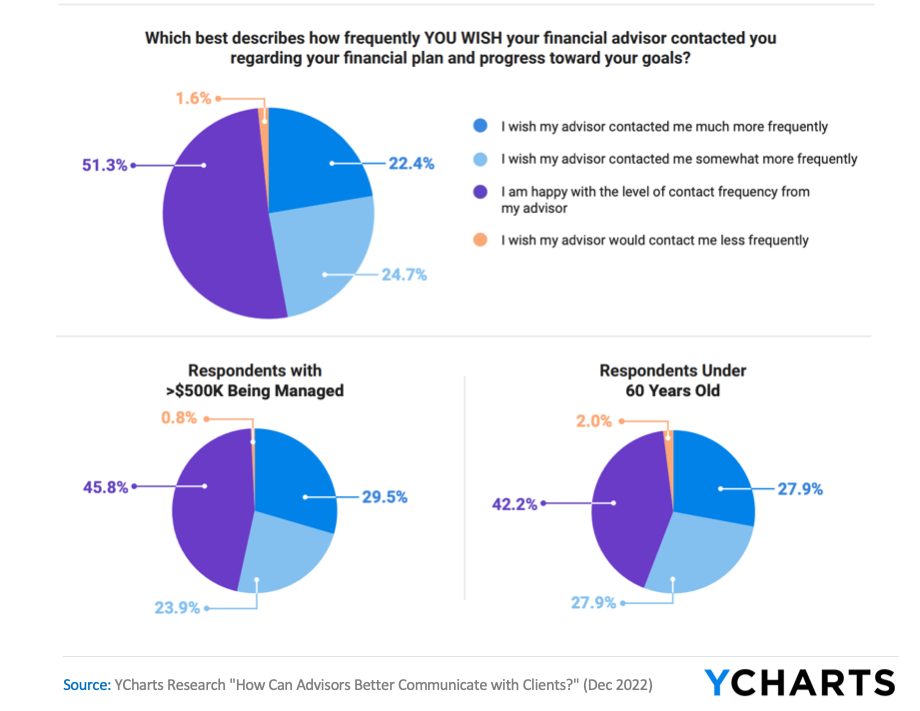

Couple of important findings:

- Almost 50% of Clients say they “wish” Advisor contacted them more

- That increases almost 60% for older and higher value clients (+60 and >$500k AUM)

These recents studies again reinforce importance of meeting these new Client expectations.

Takeaway #4 – Advisors have no more excuses in 2023 with access to easy and affordable ways to scale Client communication.

Between 2020 and 2023 many things changed for Financial Advisors and their Clients, but luckily new tools are available to help close the communication gap.

Clients have been through a rough few years dealing with the stress of the pandemic, then the uncertainty of a declining stock market, rising interest rates and potential job layoffs. Working at home means that many people spend more time connected the digital world with real time access to news, information, and people offering tips and financial advice. It’s understandable that in this new reality Clients expect more interaction with the person responsible for handing their financial future.

These modern Client needs are increasing the pressure on Advisors. Advisors need to spend even more time educating, reassuring and servicing these Clients. Luckily technology has come to help.

Advisors now have access to many types of affordable new technology designed to deliver significant efficiency and effectiveness impact within their practices. Much of it is , by allowing them to better understand and service more clients, more easily.

Advisors at bigger firms tend to benefit more from technology, where resources enable investment to find, test and implement more solutions. Bigger firms also tend to have more centralized operational support for advisors, in some cases offering Done4U type services designed to save time for all Advisors, delivering tremendous efficiency across the firm.

Client communications are an excellent example of potential impact of these centralized programs, where Clients at bigger firms see much higher frequency of contact from their Advisors vs RIA’s. (70% vs 54%).

- Only 54% of RIA Clients say Advisor contacts them frequently

- 70% of Wirehouse / Broker-Dealer clients say Advisor contacts them frequently

In 2023 there are no more excuses for Advisors at any firm. All Advisors have access to efficient communication solutions that make it easy and affordable to scale up their level of personalized interactions with prospects and clients.

Some of these new Advisor communication solutions combine cutting edge data intelligence and automation, to help Advisors be as productive as possible. They connect to an Advisor’s CRM, using variety of data sources to understand what each prospect / client is interested in, automate lead nurturing activities, then provide the Advisor with Next-Best Hot Lists and detailed r

If you are interested in learning more about Advisor communication solutions, we’re glad to chat, or here is a list of a few we recommend exploring.

| Name | Key Feature | Best For | Annual Price per Advisor |

|---|---|---|---|

| ReachStack | Automated Lead Nurturing Sales Intelligence Centralized, Done4U & DIY options Custom & Branded Content | Wirehouse Broker-Dealer RIA | $600 – $1500 |

| FMG Suite | Website & Email Content Library | RIA | $2000 – $5000 |

| Advisor Stream | Automated eNews 3rd Party Content | RIA | $1500 – $3000 |

| Snappy Kraken | DIY & Automated options Content Library | RIA | $1800 – $3500 |

Sources for information in this post:

- Smart Asset Study Dec 2022 – Financial Advisor and Client Communication

- YCharts Study Dec 2022 – How can Advisors better communicate with Clients?

Want to make your Client Communication Easy, Efficient and Impactful?

Book a demo to discuss your business and how we can help you use communication to quickly increase your client satisfaction, retention and likeliness to make a referral.