Client Data Is Now Prospecting Gold For Advisors.

Financial Advisors are using modern technology to turn Prospect and Client data into business Gold.

By Brendan Kenalty | MBA | CMO

———-

Advances in technology now make it easy to collect, analyze and use Data to generate unprecedented growth and efficiency impact across many industries and business functions.

For Financial Advisors, automated data gathering, interest analysis and AI driven nurturing is the next gold rush. It’s a highly efficient way to build relationships and close business.

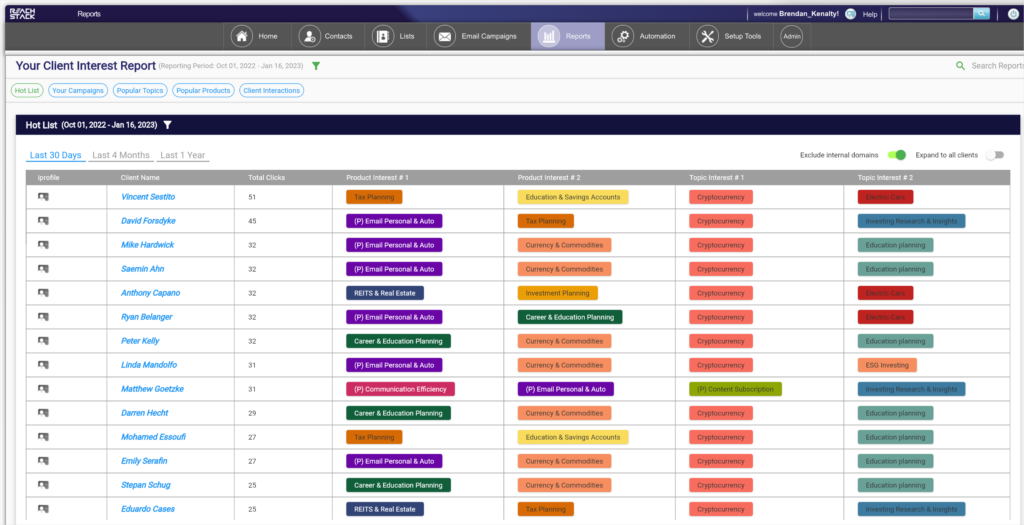

What if you automatically knew what products & services your clients & prospects were interested in?

What if you could easily use this information to educate, reassure and nurture Client relationships?

Advisors who access and action relevant information about a prospect’s needs and interests, close new Clients more quickly and efficiently.

The value of a financial advisor lies in your ability to understand your clients’ unique financial situations and goals, and to use that understanding to provide personalized advice, guidance and service. A good advisor can help a client to clarify their financial objectives, create a comprehensive plan to achieve them, and then implement and monitor that plan over time. This process can be especially valuable for people who are not financially literate or who lack the time, knowledge, or inclination to manage their own finances.

One of the key ways that a financial advisor can better understand their clients is by taking the time to get to know them on a personal level. This might involve asking about their current financial situation, their future goals and aspirations, and any concerns they have about their finances. The advisor should also gather information about the client’s assets, liabilities, income, and expenses, as well as their risk tolerance and time horizon. This information will help the advisor to create a financial plan that is tailored to the client’s unique needs.

Another way that a financial advisor can better understand their clients is by keeping abreast of the latest financial trends and developments. This might involve staying current with changes in the stock market, changes in tax laws, and new investment products. This knowledge can help the advisor to provide their clients with the most up-to-date advice and guidance.

One of the main benefit of having a financial advisor is to keep your emotions in check and to avoid making hasty decisions. Often times, people may make impulsive decisions that can be detrimental to their financial goals when they’re under stress, such as selling an investment when the market is down and buying when it is at high. Financial advisors provide objective, unemotional advice which will help their clients to avoid these types of mistakes.

Another important role of the financial advisor is to help their clients with the investment process. For many people, the investment process is overwhelming and daunting. Financial advisors can help their clients to understand different types of investments, including stocks, bonds, mutual funds, and other securities, and can also provide guidance on how to select the right investments for their particular situation. They can also help their clients to monitor their investments over time and to make any necessary adjustments to their portfolio in response to changing market conditions.

A financial advisor can also assist their clients to plan for retirement, this includes helping them to estimate how much money they will need to save in order to have a comfortable retirement, and also how to invest their savings so that they will grow over time. They can also provide guidance on how to create a retirement income plan that will provide a steady stream of income during retirement.

A better informed financial advisor can play an invaluable role in helping their clients to better understand their finances and to create a plan to achieve their financial goals. A good financial advisor can provide personalized advice and guidance, help clients to stay current with the latest financial trends and developments, keep their emotions in check, manage their risk, assist with investment process, and plan for their retirement. A financial advisor can be a great resource for anyone who wants to take control of their finances and create a secure financial future.

Want to learn more about Prospect Hot Lists, Client Interest tracking or Done4U communications? Book a demo or sign up for free trial now.