The Future of Advice is Female

Meeting the Evolving Needs of Female HNW Investors

Women are a growing economic force in the world, controlling one-third of all wealth. Yet many wealth management firms and the industry as a whole continue to misunderstand the needs of women investors leaving them underserved.

In this article, we will review some of the research on younger high net worth (HNW) female investors and highlight strategies for advisors to differentiate themselves to serve this market better.

According to a global study by BCG, Managing the Next Decade of Women’s Wealth: “Too many banks and firms rely on broad assumptions about what women are looking for, resulting in products, services, and messaging that can feel superficial at best and condescending at worst.”

Among the key themes identified by the BCG study is the financial empowerment of a younger generation of women, underscored by this fact: “An impressive 70% of millennial women (those born between 1980 and 1995) said that they take the lead in all financial decisions, compared with just 40% of female baby boomers.

Shawna Dennis, Vice President of Marketing and Communications at MD Financial, echoes this: “One of our key growth targets at MD Financial are young doctors, many of them women. Recognizing that this growing segment of highly intelligent and empowered women want to feel more comfortable understanding and participating in their personal finances, our communication and service strategy is evolving to support them.”

Dispelling the myths of female investors.

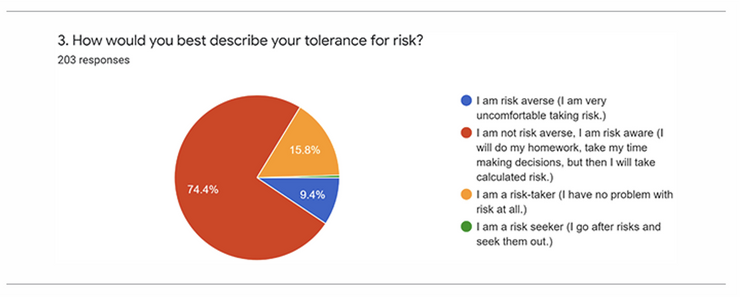

Barbara Stewart has been researching female investors for over a decade and much of her work has focused on dispelling the myths that inform much of the investment industry’s marketing aimed at women – in particular, that female investors were not confident/independent enough, that they were risk averse and that they needed to be educated about how to invest.

Based on hundreds of interviews with female investors, Stewart’s research (see Woman and Finance: The 2019 Rich Thinking Quantitative Survey Findings) revealed that each of these generalizations were not just slightly off, but totally backwards. Stewart found the majority of the women she interviewed were making investment decisions entirely by themselves or by themselves with some input from others. And female investors did not self-identify as risk averse, rather they reported attitudes that more accurately might be classified as “risk aware”. Finally, a relatively small number of women cited a course or any formal education process that got them into investing; most point to mentors, friends and family, and online tools for their investing education.

Women investors are striving for financial independence and tend to have different motivations for investing and building wealth – needs that often go unmet by traditional wealth advisory practices, according to Stewart.

Younger female investors demand more from Advisors.

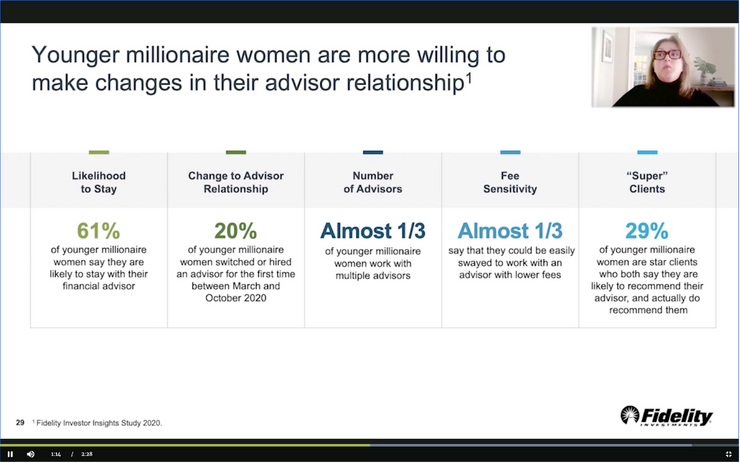

Research recently conducted by Fidelity Investments highlights the changing needs of younger female HNW investors. (See Female Millionaires Are Getting Younger, Demanding More from FAs.)

One example is the traditional use of professional referrals that have worked well with older female HNW investors may not work as well with the younger generation. According to Fidelity’s Melissa Henderson: “While referrals remain important, younger millionaire women are much more likely to use online sources, a blog, social media, looking at websites, when they find an advisor.”

Younger women investors also tend to focus on product and service offerings more than the reputation of the advisors’ firms. And they’re much more willing to change their advisor relationship if their needs are not being met, according to Fidelity’s research.

These wealthy young women make excellent clients. They are more loyal to an advisor if being serviced well, almost 3 in 10 will actually provide referrals, and they appreciate value (though they are fairly sensitive to value versus fees).

3 Ways to Better Serve Female HNW Investors.

Understanding the needs and motivations of female HNW investors will help you implement practical strategies for differentiating your practice by serving this important market even better. Based on the research highlighted above, here are some ideas to consider:

1. Financial independence is a huge part of why women invest.

Financial independence drives not only why, but also how, a new generation of women invest. The fintech and wealthtech revolution has brought many self-service investing tools that are empowering young female investors. Social investment communities are emerging to support independent female investors in a number of new trends, such as copy trading (mimicking another person’s trades in real time), social communities promoting communication about all things related to investing and mobile investment clubs.

According to Barbara Stewart: “As advisers we need to encourage them to embrace online investing platforms, clubs, and communities… Financial knowledge builds confidence and the freedom to pursue the careers and lives that we want.” (See She’s the Boss of Her Money: Four Trends in Women’s Online Investing.)

Advisors who are tuned into and supportive of the female investor’s desire for financial (and other kinds of) independence can forge a new role for the financial advisor as a coach, mentor and all-round facilitator of their clients’ goals and aspirations.

2. Frequent, factual communication is more important than ever

Since younger female investors are paying more attention to social media and online sources, advisors’ communication strategies are becoming increasingly important. More advertising and salesy marketing pitches just aren’t going to cut it with a new generation of women investors who are interested in learning – not being sold to.

Consumers are bombarded today with digital media and messages about their financial wellbeing and investment strategy – and advisors need to be present in that conversation. The days of quarterly updates and annual meetings with clients may still work for some clients, but traditional communication strategies are not meeting the information discovery, self-directed learning and overall digital communication needs of an increasing number of clients and prospects.

More frequent communications with clients and prospects will go a long way to addressing these investors’ needs for fact-based information on products and services tailored to their needs.

3. Superior customer experiences that are shareworthy

Creating a superior customer experience is driving innovation in many industries – and this is no less the case for wealth management.

Crafting and delivering a better customer experience for female investors increases satisfaction and retention, but also drives word of mouth referrals. Female investors are seeking customer experiences that make them feel comfortable and confident – they are looking for advisors that listen to their needs and concerns and educate rather than sell.

When an experience with a financial advisor exceeds an investor’s expectations and is different from a typical advisor experience, it becomes remarkable and shareworthy.

According to Penny Phillips of Journey Strategic Wealth: “The best in the business don’t actually have to say those words – ‘Would you mind introducing me to your neighbor?’ – because they’ve created a referrable experience. They are constantly focused on creating experiences that clients will notice, appreciate, then naturally share with a friend or two.” (For more on making your practice referrable, listen to Penny Phillips on What it Takes to Run a Successful Business, Becoming Referrable Podcast with Julie Littlechild and Stephen Wershing.)

The Future of Advice is Female.

Wealth management and financial advisory is undergoing major transformations driven by technological innovation and demographic shifts. Younger female HNW investors are a growing opportunity in the market, but demanding a new type of service that is more collaborative, interactive and built on a consistent stream of education, information and support. More female advisors are entering the industry and taking advantage of this evolving demand.

The future of financial advice is less about storied brands telling clients to just trust them – and more about co-creating an advice experience that empowers clients to achieve their life goals.