How Wealth Firms drive Tech Adoption

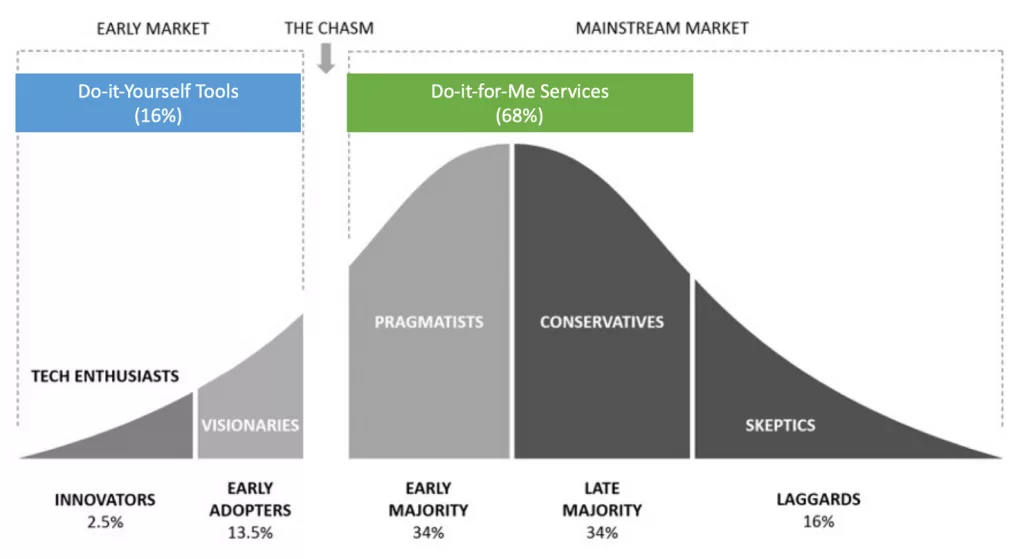

Wealth Advisory firms are exploring Do-it-for-Me Services as way to finally “cross the chasm” with Advisor technology adoption by Shifting from Do-it-Yourself Tools to Do-it-for-Me Services.

Home Depot has spent years built an army of Do-it-Yourself (DIY) home owners empowered with the information and tools to take on almost any project. It’s terrific. Survey’s show that 75% of people love it, actively do it and find it an empowering and rewarding experience.

Wealth Advisory firms have also spent years and millions of dollars trying to build a technology empowered DIY Advisor, but with less success. Where 75% of people practice DIY home repair, industry feedback shows only 15% of advisors want their own digital marketing toolbox. The majority want the benefit, but prefer a service that just does it for them.

Advisors have reached peak Do-it-Yourself Tools

In the world of advisor tech, the first digital marketing tools were DIY tools and many of these are still around and in use. However, these tools have consistently been adopted and used by only a small minority of advisors to service and satisfy their clients changing expectations. Firms have invested millions rolling out a robust set of DIY advisor marketing tools, but despite this tremendous effort we still only see adoption by a small percentage of advisors (10-15%).

Most advisors we talk to say they are actually drowning in a sea of DIY tools, but the challenge with adoption is not having the resources or appetite to effectively learn and use them all. Advisors realize these programs have value and will impact their business, but want to spend their time working with clients instead of fiddling around with new applications.

Based on conversations with Wealth leaders across the industry, we seem to have reached the peak of providing DIY tools for Advisors, and predict rapid adoption of a new suite of technology enabled do-it-for-me (DIFM) services.

Do it for me, please.

A new generation of DIFM marketing technology services are emerging. These services make it easy and affordable for Advisors to adopt best practices with the click of a button. ReachStack’s Client News Service is an example of this.

“Only 10% of our advisors want the control of doing things themselves, the vast majority just want things done for them.” ~ Senior Wealth Marketing Leader

In a way that will be familiar to advisors, these DIFM solutions offer a number of benefits to wealth advisory teams, such as:

- It’s Easy – There are so many tools. Each tool has a learning curve – it takes time to figure out how to use it, then even more time to figure out what works best in different situations. With DIFM services like ReachStack, you can get more done in a fraction of the time and achieve better results because the team delivering the services built the tool and knows exactly how to use it best.

- Delivers Impact & ROI – When you get more efficient with operational execution, you free up your time to do more high-value work. In the world of financial advisory, that high-value work typically involves facetime with important clients and prospects.

- Keeps you Up-to-Date – Tools and technologies, especially in marketing, are constantly changing and your administrative support team can’t be expected to know and do everything well. DIFM services make it easy to supplement your team’s capabilities without needing to recruit or retrain for new skills.

- Rapid impact – Unlike tool that have learning curve, you turn on a service and get instant impact. Many helpful tools are under-utilized because there’s either not enough time to use the tools or to develop the experience required to use them effectively. DIFM services deliver impact quickly with no training investment.

Crossing the Chasm for Advisor Adoption.

In his book, Crossing the Chasm, Geoffrey Moore famously identified a large gap that existed in the adoption of new technology between the early adopters and the early majority. That gap demonstrates that the innovators and early adopters are wildly different from the early and late majority users – and what works with the first group won’t work with the rest.

It’s interesting to note this model predicts the difficulty getting past our current 16% Advisor DIY tool adoption, as it’s the point where typical technology adoption stalls before making the changes required to jump into the mainstream.

This is precisely where the wealth advisory industry is today. The industry is going through a client experience revolution. Firms and advisors know they need to embrace delivering a better digital experience that clients now demand, but change has been slow.

Over the past two years, I’ve had conversations with over 100 leaders in the wealth industry and two things have struck me. The first is the consistency in the low rates of adoption of DIY marketing tools. The second thing is the consistent theme in the comments made by people at every level in wealth advisory organizations: “we have enough tools” they tell me, or “we don’t have time to use all the tools we already have.” Advisors and marketing teams are drowning in a sea of tools, but don’t have the time or resources to turn these investments into business results.

“The last thing our firm needs is another tool, what we need is help delivering more client programs. That’s what impacts the business.” ~ Senior Wealth Marketer Leader

In order to win majority adoption of the technology tools needed to succeed in the wealth advisory industry, firms need to cross the chasm – and DIFM services are the bridge.

About ReachStack

ReachStack is an enterprise level personalization and automation platform for advisor-client communications. Our “do-it-for-me” approach results in 70 percent advisor adoption vs. 10 percent adoption for most “do-it-yourself” tools. Easily scale advisor-client interactions across your firm from 4 to 100x a year, by helping Advisors deliver up to 20 personalized, sharable client interactions a month in only 5 minutes a day.

For more information please book a demo or contact us info@reachstack.com or 1-877-977-8225.