Pandemic Has Wealth Clients Seeking Advisor Insights

Report: New Data Proves Clients Want More Communication From Advisors

Updated: Apr 20

COVID-19 Pandemic Has Wealth Clients Clamoring for Advisors’ Insights

TORONTO, ON – ReachStack, North America’s leading content automation platform for wealth management firms and their advisors, has shared findings from an analysis of Client engagement in the wake of the COVID-19 crisis, financial market dip and ensuing rebound.

According to a recently released analysis of ReachStack user data, wealth clients have dramatically increased their engagement with advisors as they seek more insight into how to navigate the ongoing COVID financial crisis. ReachStack conducted an analysis of more than 1,000 users on its content distribution platform and discovered a surge in digital interactions between advisors and clients from February to August 2020.

A few highlights:

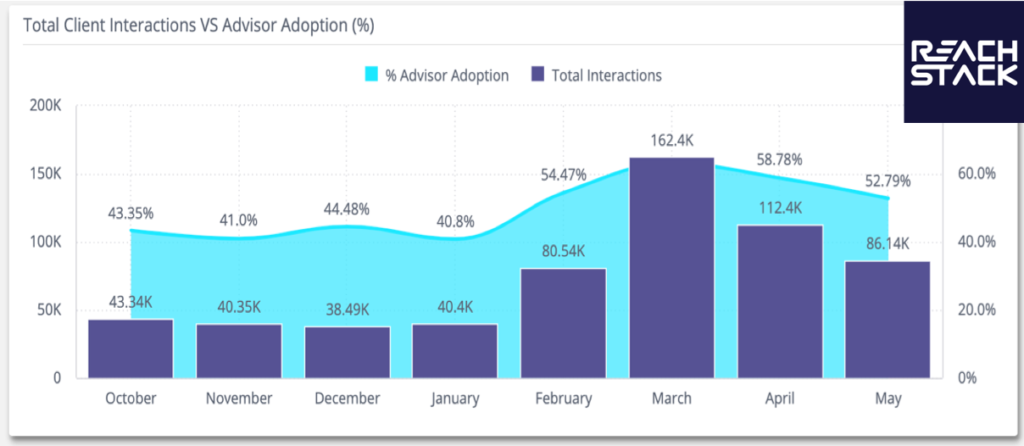

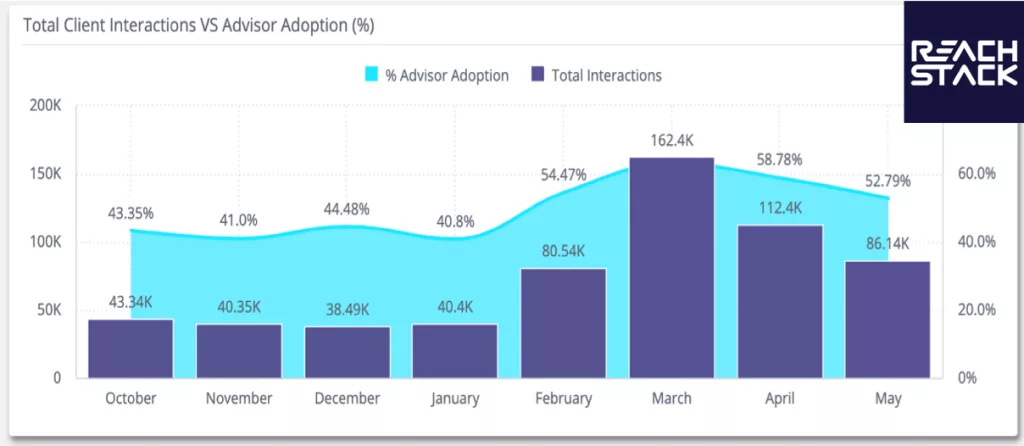

- Digital Interactions between Advisors & Clients jumped 400% in March

- Advisor adoption of digital content sharing up 50%

- Frequency of Advisors sending information to their clients up 250%

- Email open rates over 65%

- Click through rates increased more than 25%

The data shows that email interactions between advisors and clients increased by +200% February to May, and an incredible 400% in March. Given the convenience and personalization of emails, clients were actively engaged in wealth managers’ communications. Email open rates surpassed 65%, a statistically significant number that suggests greater adoption would benefit wealth marketing teams and financial advisors. In addition, click through rates increased by more than 25%, as clients took additional time to open links to research, unique content, and advice sent by their advisor. This click-through rate is also very high and signals the increasing level of trust that clients feel about communications with their advisors.

“This recent analysis of ReachStack user activity, signals greater trust and reliability of email communications between advisors and their clients. Based on the recent market downturn and sudden recovery, clients are eager to receive as much input and insight as possible from their wealth advisors. An email open rate of 65% signals an incredible amount of trust from the clients, and advisors should recognize that personalized emails that cater to their clients’ needs is an extremely reliable and viable channel for communications,” said Sean Kenalty, ReachStack co-CEO and CTO.

The data also signaled that advisers are engaging in more digital content sharing with clients. According to the survey, advisor adoption of digital content sharing increased by 50% during the period. Meanwhile, the amount of content shared from advisors to their clients increased by 250% during the period. The data suggests that advisers are maximizing their time by adoptions digital content platforms that can cater to their large pool of clients. In addition, this marketing channel has proven to be an effective channel catered toward greater recruitment of new clients.

“Our ongoing analysis of wealth advisor and client engagement user data, shows that digital adoption remains a growing trend in the wealth management space. When major macroeconomic events happen and markets become volatile, every client wants to pick up the phone and call their advisor. But how can managers communicate with all clients while still engaging in portfolio management and working to prospect new clients?,” said Justin Parker co-CEO of ReachStack.“Content automation platforms like ReachStack continue to prove their value by increasing touchpoints, reducing compliance bottlenecks, and ensuring that wealth managers can send more personalized content in less time.”

About ReachStack

ReachStack is the first fully compliant, centralized client communication and content distribution platform made by wealth advisors for advisors. Our platform utilizes artificial intelligence to mine communications for data and insight, then efficiently streamlines client engagement and AUM impact. For more information, please contact Brendan Kenalty, CMO at brendan.kenalty@reachstack.com.