Evolving Advisor Digital Marketing

Evolve your Advisor Digital Marketing : Help 90% who can’t do DIY

Updated: May 2, 2020

If you are like most Wealth Management firms, the top 10% of your Advisors are rockstars who follow every best practice, use every tool and program you provide, and have embraced Digital Marketing to grow their business.

Now let’s talk about the other 90%. Over our 15 years working with marketing leaders at Wealth Management firms, most agree there is tremendous growth opportunity within this cohort, but struggle to help them leverage the best practices and tools which drive the success of the top 10%.

The Challenge : Do-It-Yourself Tools benefit top 10%, not the other 90%

One of the biggest challenges has been providing Do-It-Yourself (DIY) tools to Advisors that are already time and resource constrained. Take digital marketing for example.

Most firms now provide a range of high quality DIY tools for advisor websites, blogs, email campaigns, content marketing & social sharing. These tools are very powerful, well intentioned and extremely effective for top 10% of Advisors, but as the data now shows, <10% of Advisors across all firms actively use these tools, and after paying un-used license fees for years, are starting to phase them out.

Opportunity to Evolve Program : Activate the other 90%

The digital marketing tools work when used consistently by Advisors. The break-down in current approach is the operational model that puts the burden on the Advisors to use them effectively.

“All our Advisors want the digital marketing impact, but without having to do the work themselves.” – VP Marketing @ leading Wealth Management firm

Over the last 15 years, we have been collaborating with our customers to constantly evolve how we can approach and enable maximum business impact from digital communications. Advancements in technology means we now entering a 4th phase :

- Phase 1 = Marketing sends content directly to clients & prospects (email / social, limited branded audience size, and low response rates)

- Phase 2 = Give Advisors Do-It-Yourself tools to share approved content via email / social (worked well but only <10% adoption so limited impact)

- Phase 3 = Marketing sends to clients, but from Advisor’s email (“on-your-behalf” or OYB, not widely used as Advisors rebel against no control of client experience)

- Phase 4 = Marketing uses AI, analytics & automation to drive communications activity, but Advisors control Client Experience (Winner so far delivering 16X impact with collaboration between advisors & marketers)

As we evolve into this exciting 4th phase of Digital Marketing and communications, we are finally able to help the 90% of Advisors who will most benefit from the best practices and technology to grow their businesses.

ReachStack enables Phase 4 : 16X impact through effective Marketing | Advisor collaboration

ReachStack is a Content Distribution Platform designed to enable a Marketing team to help Advisors easily share high value, relevant content with clients more frequently. By delivering a steady stream of strategic high value information, Advisors are able to increase the number of interactions with clients, accelerate building their trusted advisor relationships and grow their business.

What is unique about ReachStack?

ReachStack was designed as a true partnership between Advisors and Marketing. A process aligned around creating best data driven user experience (UX) for clients, maximizing value to firm, instead of current adversarial relationship around who controls the type an style of what gets sent to clients.

ReachStack uniquely addresses this by creating a WIN : WIN : WIN opportunity for your Marketing Team, Advisors and Clients with clear benefits to all 3 groups :

- Clients : Get more relevant information & value from their advisor more frequently, helping them feel more comfortable about relationship and value they get for fees.

- Advisors : Get Marketing team to source & distribute more high value information for their clients, increasing high value interactions and accelerating trusted advisor relationship

- Marketing : Can leverage their team to drive content creation, distribution & impact, by better leveraging high value content to help Advisors grow their business

ReachStack achieves this collaboration by adding 2 new features into our Content Distribution Platform :

- Marketing sends On-Behalf of Advisor : Marketing can access central content library, review content performance then easily plan, create & send relevant communications to clients across the enterprise more frequently, addressed from their specific Advisor (vs the brand)

- Simple 1-Click Advisor SEND STOP EDIT : Advisors are notified via email (in future by app) and must approve ALL communications planned for their clients PRIOR to it being sent out. It is very easy for Advisors to SEND STOP or EDIT each communications with simple 1-click of button. Any edits are routed back through standard compliance process embedded in platform.

How does ReachStack deliver 16X increase in Advisor | Client Interactions?

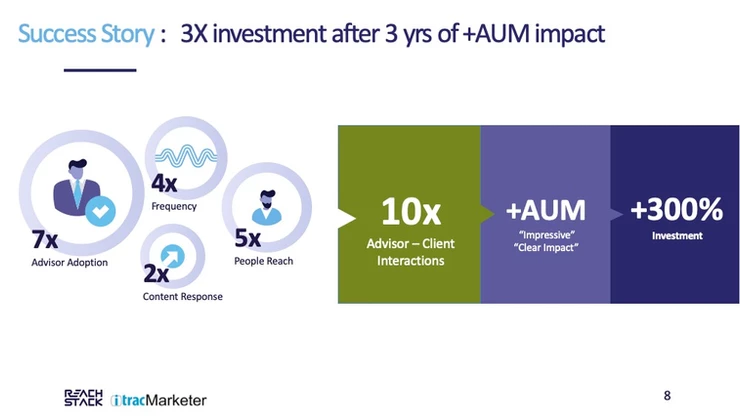

The ReachStack results come from enabling collaborative Content Marketing & Distribution programs where Marketing is able to drive the planning, execution and optimized performance, but Advisors have 100% control on what goes to clients. This type of approach impacts metrics for 4 core activities which together deliver a minimum 10X increase in # of high value Advisor | Client interactions.

- Advisor Adoption (7x) = By providing Marketing support with Advisor Approval function, we see dramatic increases level of Advisor participation in content sharing programs (75% vs 10% for DIY Advisor tools).

- People Reach 5X = By increasing Advisor participation, you significantly increase the size of your audience and people you reach as your content is now shared by more advisors to more clients.

- Frequency (4X) = Moving from monthly to weekly content (52 vs 12X a year)

- Content Response (5X) = Emails from an Advisor average 5X the response rates of emails from Brand (75 vs 15% Open Rates, 30 vs 5% Click Through Rates (CTR). People care a lot about their money, so makes sense that when their Advisor sends something of value, they open and read it.