Financial Literacy is the new prospecting qualifier for Advisors.

Clients with higher Financial Literacy are more valuable to Advisors.

Advisors who focus their efforts on high Financial Literacy clients & prospects see tremendous benefit in their business.

Written by Brendan Kenalty | MBA

Financial Literacy is a hot topic right now creating a terrific opportunity for Advisors.

Advisors who adopt Financial Literacy as way to qualify prospects and identify which clients to focus their time on are seeing significant business impact.

What is Financial Literacy?

Financial Literacy is the ability for an individual to understand and use various financial skills including budgeting, debt management and investing, to make more informed and beneficial decisions about their money.

Studies show that an individual’s level of Financial literacy has a direct impact on their future financial security, net worth and health by reducing #1 cause of stress, worrying about money.

Only 30% of US adults are Financially Literate.

With only 30% of US adults considered financially literate or confident making decisions about money, the growing wealth gap and spiralling consumer debt has pushed legislators to add Financial Education to high school and college curriculums in 26 states and counting.

Amplifying this Financial Literacy opportunity for Advisors, is the $10 Trillion in wealth being transferred from from Baby Boomers to their unprepared millennial children, 86% of which will leave their parent’s advisor citing no understanding of the value the Advisor provides.

3 ways Advisors benefit from Clients with higher Financial Literacy.

Advisors see tremendous benefit from having a book full of Financially Literate clients and prospects. Here are 3 examples how.

Advisor Benefit #1: Better understand the value of Advisor’s expertise

In the new world of free information, Finfluencers and Robinhood, it’s hard for Advisors to illustrate the value of their expertise and support. This is much easier if a client has a foundational level of Financial understanding.

As an illustration, imagine you are a music lover talking to someone about music at a party. As the conversation progresses they demonstrate tremendous knowledge and insight on every area you discuss, even peaking your curiosity and suggesting some new music to try. You walk away thinking they are a great new connection for any questions, suggestion or advice about music.

In this example, the fact you had some foundational knowledge on music gave you the context to understand the knowledge and value of the expert you met. As contrast, If you knew little about music, the discussion would not have been as impactful, or have the potential for a longer relationship. The same principle applies with Financial Literacy.

Advisor Benefit #2: Want more personalized support

Client with higher levels of Financial Literacy are more sophisticated, and appreciate the importance of personalized support. The see through cookie cutter solutions, and demand an advisor who takes the time to understand the nuances of their specific situation, then provides personalized recommendations and advice.

Advisor Benefit #3: Have a higher Net Worth

Studies show that an individual’s level of financial literacy has a direct correlation with their financial health and Net Worth. This makes sense of course. Individuals with an interest or aptitude for the key personal finance skills are more likely to apply them, make better financial decisions, and improve their financial situation.

For Advisors, higher net worth provides the opportunity for increased revenue both from a higher AUM, but also providing a broader range of services and investment options.

2 ways Advisors can leverage Financial Literacy for growth.

Advisors are in a unique position when it comes to financial literacy. As experts in the subject there are 2 ways Advisors can leverage Financial Literacy as operating strategy in their practice.

Advisor Opportunity #1: Educate to increase Client value

The first opportunity Advisors have is to use their credibility and interactions to educate their clients and prospects, increasing Financial IQ and their value as a client. This ia a subject which we discussed in previous articles.

Advisor Opportunity #2: Focus time on clients & prospects with high Financial Literacy

The second opportunity Advisors have around Financial Literacy, is to use their expertise to determine a client or prospect’s level of knowledge, then illustrate their value by engaging with more sophisticated, personalized and impactful thoughts.

The opportunity for Advisors is to focus on finding, qualifying and closing prospects with high Financial Literacy, as core strategy to building practice value over long term.

How can Advisors find prospects with higher Financial Literacy?

Finding clients and prospects with higher levels of Financial Literacy is not as hard as it sounds. Advisors can modify the interactions and activities they already do to incorporate a layer of Financial Literacy qualification.

- Use every interaction to Educate them yourself (as discussed in previous articles)

- Participate in events where Financial Literacy is being taught (eg. schools)

- Add Financial Literacy scoring to your regular communications

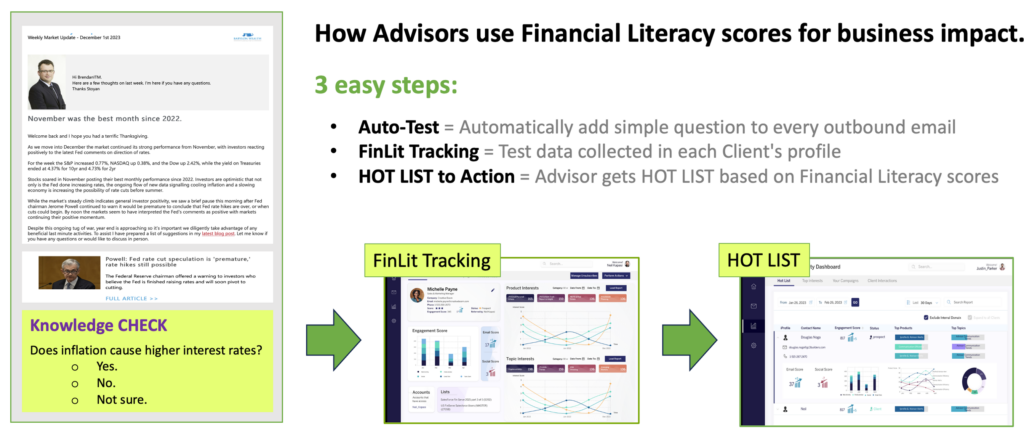

This third suggestion is new program we are working on at ReachStack. Using our email communication platform we can easily add a “knowledge check” into each outbound communication and Advisor sends, then track & report on each contact’s response,, allowing the Advisor to see real-time Financial Literacy scores on every contact in their database.

For enterprises, helping your Advisors identify and focus their efforts on clients and prospects with the highest Financial Literacy can have big impact on the firm.

Let’s discuss.

We encourage you to reach out and share your thoughts on this subject with Chris Crocker, Tara McIlroy or I. We spend a lot of our time talking to Financial Advisors and wealth management executives about this subject, we are glad to share any insights and look forward to connecting.

Related articles:

- Financial Literacy is key to the Client/Advisor Relationship

- How to use Financial Education to build Client Relationships

- The Power of Financial Literacy: Enhancing Client Value for Wealth Management Firms

Request a Demo

Brendan Kenalty

Brendan is a recognized thought leader and advocate for Wealth Management firms using modern Client Communication and Financial Education as a growth engine for their business.

Though his involvement with ReachStack, Brendan works with Executives and Marketing leaders across the Financial Services industry to deliver digital content sharing programs that drive impact and positive ROI for Financial Advisors.