Financial Advisors Rejoice As Digital Shifts To Done-for-Me Service.

80% of Financial Advisors are set to rejoice, as Digital Marketing shifts from Do-it-Yourself to Done-for-Me service in 2023.

By Brendan Kenalty | MBA | CMO

———-

Some exciting news from the field around Financial Advisor Marketing, and how much easier digital is about to become as our industry shifts to Marketing-as-a-Service.

In 2023 we will see the rise of Done-for-You Digital Marketing as a Service for Financial Advisors.

80% of Financial advisors are getting a big gift for their business this year, as the shift from Do-it-Yourself digital marketing tools to Done-for-Me services is picking up steam.

As an Advisor marketing, technology and business growth partner, this is very exciting. For last 3 years we have been talking to Wealth Management leaders about the opportunity to dramatically increase adoption and impact of Advisor digital marketing by adding a Done-for-Me service option to the mix.

Most advisors and firms appreciate that tremendous impact an effective digital marketing program makes in today’s market. The challenge has been a slow grind around adoption, leading to higher support costs and lower then expected impact for advisors and their firms.

While 10-20% of Advisors see the results from embracing Do-it-Yourself digital marketing tools now widely available in the industry, the vast majority of Advisors still have not.

For the remaining 80% the challenge is time, effort and expertise it takes to effectively use a new “tool”. Advisors are currently being bombarded with new technology and platforms, as firms aggressively ramp up investments to modernize both the client experience and advisor support capability. The last thing Advisors want or need, it another tool to learn and use.

Conversation is now about Marketing as a Service.

In the last 6 months the conversation has dramatically shifted. As core technology gets put in place, many firms are building a more robust shared Marketing Services functions or partner programs designed specifically to ensure the 80% of Advisors who want the impact can easily get it.

Efficiency and effectiveness are the focus. Firms are looking for new centralized services which Advisors will adopt, allowing them to scale business impact across the organization.

The full court press is now on. Several firms have hired experience Marketing Services executives from other industries to accelerate the build outs, and we are seeing a real increase in interest for information and proposals detailing the what, how and when of rolling out these services.

Done-for-You Services will finally drive Advisor Digital Marketing adoption across the chasm.

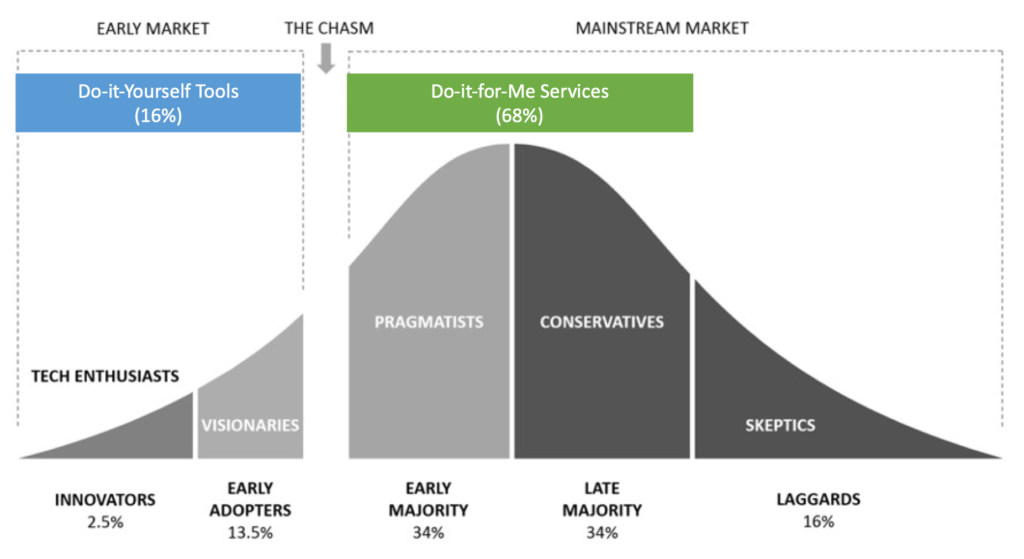

In his book, Crossing the Chasm, Geoffrey Moore famously observes the gap in adoption of new technology between the early adopters and the majority. Moore also observes that the traits of the early adopters are very different from the majority of users – and what works with the first group won’t work with the rest.

This model predicts the difficulty getting past our current 20% Advisor DIY tool adoption, as it’s the point where typical technology adoption stalls before making the changes required to jump into the mainstream. Our recent blog post did deeper dive on this topic.

The shift from tools to services is what will accelerate adoption by eliminating the burden on Advisor, specifically addressing feedback such as “we have enough tools” or “we don’t have time to use all the tools we already have.”

“The last thing our firm needs is another tool, what we need is help delivering more client programs. That’s what impacts the business.” ~ Senior Wealth Marketer Leader

New Technology now enables Firms to efficiently provide Marketing as a Service.

The trick to providing Marketing as a Service at a price that Advisors see value in, is to leverage technology to perform most of the heavily lifting, allowing the program’s support people to focus on servicing the Advisor.

Like Salesforce or any other technology platform, leveraging technology at the enterprise level enables a firm to efficiently provide the core elements of personalized Advisor Digital Marketing programs like communication strategy, content, data analysis, automation and client insights for all the Advisors in the program.

Modern technology powers new centrally run Marketing programs that make it easy for an Advisor to increase the level of interaction with clients and prospects, understand their appetite for advice and other services, then identify and action those revenue opportunities using automated education, nurturing or in-person meetings.

Result is a intelligent, personalized program that every Advisor can easily use to impact their business. As an example, here as some results for this type of Digital Marketing as Service program (see full case study here):

- 75% Advisor Adoption

- 16X increase in Advisor interactions (clients & prospects)

- +44 point NPS increase (NPS = Likeliness to Refer)

Who will lead the transition to Advisor Marketing as a Service?

As always I’d welcome any thoughts or feedback on these observations. What are you seeing in this area? Are your seeing the same thing? What people and firms are leading this transition?

I look forward to discussing.

Brendan Kenalty

brendan.kenalty@reachstack.com

About ReachStack

Reachstack is a data driven client intelligence, communication and automation platform for Financial Advisors and sales professionals. We make it easy and efficient for advisors to use personalized, strategic communication and content sharing as growth driver for their business. ReachStack plugs right into an Advisor’s CRM dashboard to provide actionable insight and revenue nurturing options at the contact level. Current integrations include Salesforce, Redtail, Wealthbox and Microsoft Dynamics. Coming soon are Practifi and XL8R.