Adding Human layer to your Digital Experience can deliver 300% increase

“People buy from people they like”, is a fundamental truth in business. As humans we’ve arrived at an interesting point in the evolution of digital customer experiences. The rise of sophisticated e-commerce has addicted us to the speed & efficiency of a terrific digital transaction, but people have realized something is missing from that pure machine-like experience.

Humans are social, and we want to connect with others. The last 2 years of isolation has shown that we don’t do well with pure digital interactions over the long term. Similar to the characters in those futuristic movies where everything is purchased from a vending machine, people are feeling isolated, lonely and depressed, causing tremendous stress and social anxiety. Like our excitement around seeing fans back in the stands, connecting, cheering and adding so much the the experience of the games, we need the positive energy of having people back into our transactions.

For businesses, the trick in the future is delivering simple, efficient digital transactions with a human layer that seamlessly adds that people to people connection, security and loyalty.

Adding human touch goes beyond Chat-bot and 1-800 number.

Adding a human layer to your digital experience isn’t about having them call in and wait on hold. It’s about seamlessly injecting a person into the transaction to enable buying from a person instead of nameless, faceless entity. Imaging a real person being introduced softly into the shopping experience. The next generation of chat but with actual people, their name and picture introduced. The Sales person can build rapport by asking questions, providing ideas, then facilitating the transaction, send thank you notes and follo-wup communications.

The sales person builds the human relationship and becomes the customer’s contact point for the business. The sales person uses modern technology, data and automation to efficiently understand and proactively service their customer ongoing, inviting them back to the store to visit, see the latest items or participate in special promotions.

History has proven that injecting this type of personalized service sets companies apart, building tremendous loyalty, referrals and ongoing sales.

In this article we will show how digital strategies fused with a human touch throughout the customer journey lead to growth in conversion rates, satisfaction, and positive business metrics.

Adding Human touch into Banking technology has Positive Impact

While the rise of technology witnessed during the past couple of years is here to stay, it’s also true that when consumers have questions or challenges, they desire to interact with a human.

For example, consumers love self-checkouts at stores when they have a few items to purchase, but when they have a large cart of products or want help, they would rather go to a cashier to check out.

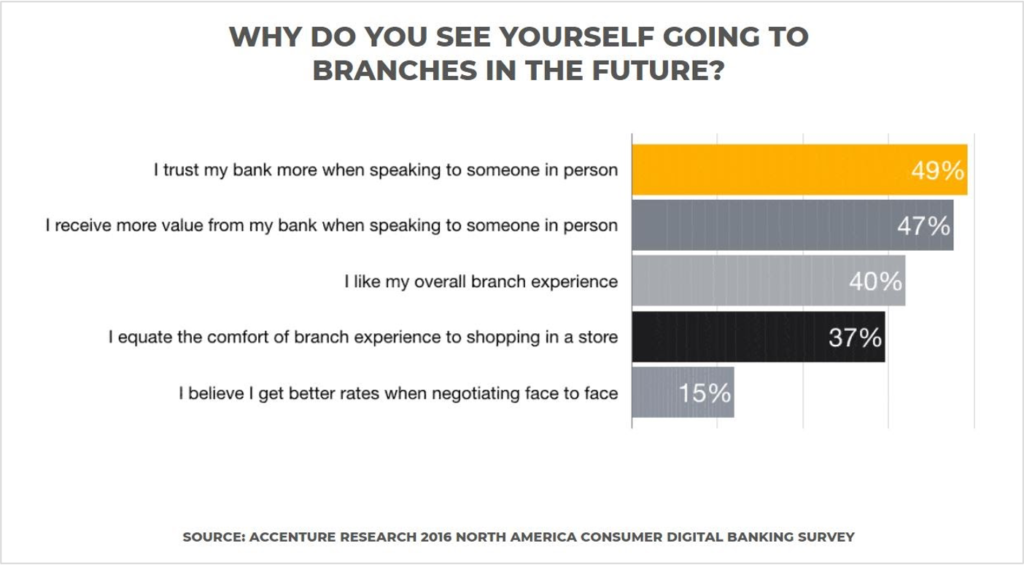

The same goes for financial services. When consumers have an important financial matter, they want to interact with a real person rather than a robot. In fact, 49% of consumers trust their bank more when speaking to someone in person rather than doing it digitally.

Source: The Guide to Humanizing Your Brand’s Digital Experience, by Jean Pierre Lacroix.

AI chatbots and digital assistants are a great way for banks to integrate a human touch into their digital channels. In some circumstances, consumers should be given a live agent to deal with a difficult problem, but for more simple queries a chatbot can be used that personalize their experience through the use of videos and empathic messaging. A great example of this is Scotiabank’s ScotiaAdvice+ initiative that focuses on every business unit across the company finding ways to connect with customers.

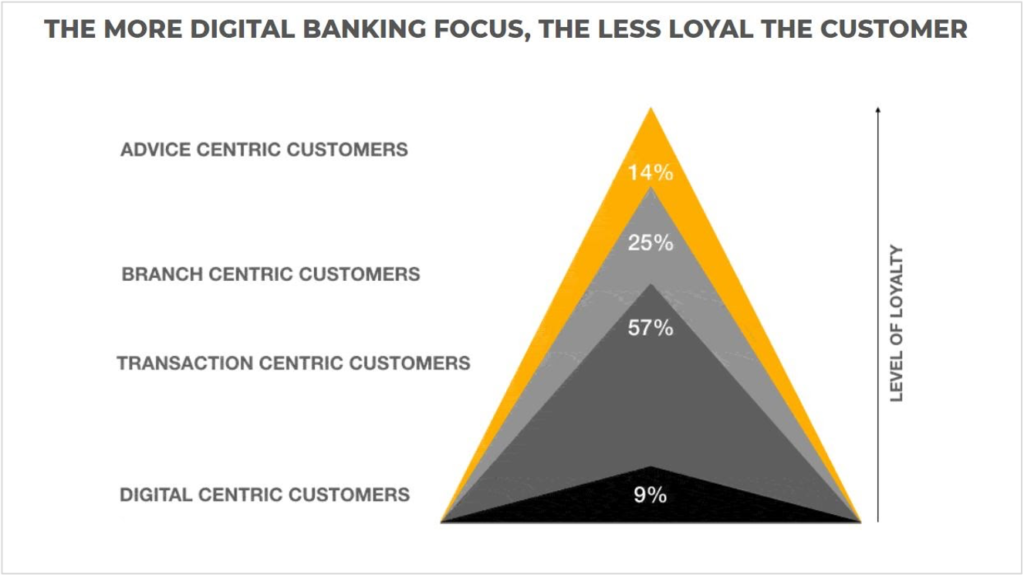

In an excellent white paper, entitled “The Guide to Humanizing Your Brand’s Digital Experience,” Jean Pierre Lacroix points to research suggesting that the increased reliance on digital technologies “can sometimes cloud our sensory as consumers, with only factual and textual information instead of an array of human emotions coming into play.” The loss of sensory judgement, Lacroix writes, “undermines consumers’ ability to emotionally connect, opening the door to apathy and losing brand loyalty.”

People to People Email Communications deliver 310% increase

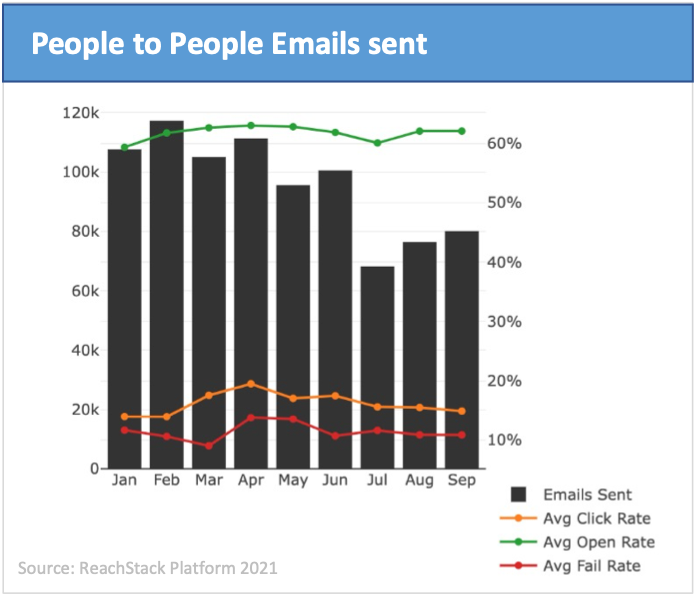

One of the easiest ways to humanize your brand’s digital experience is to shift your email communications from being sent by the company, to being sent from a person at the company. As an example, ReachStack’s email platform helps firms efficiently organize and manage sending all client communications from their advisor instead of the bank. Studies show that increasing the number of direct advisor to client interactions, builds deeper relationships leading to increased trust, satisfaction. and referrals.

New studies are showing the impact for large financial institutions shifting to a people to people communication approach. Many of the banks we talk to in US and Canada are now testing this approach to quantify the business impact of building stronger people to people, trusted advisors relationhships.

According to ReachStack data, the average email response rates when emails are sent by advisors are significantly higher than benchmark data for sending from a company. Our data shows people are over 300% more likely to open an email communications sent by a person vs company, and 64% mare likely to click on a link.

| Email from a Brand | Email from a Person | Increase | |

| Open Rate | 19.8%* | 62% | 310% |

| Click Rate | 11%* | 18% | 64% |

* See Ultimate List of Email Marketing Stats for 2021, Hubspot

In order to create an emotional connection through digital channels, financial organizations should consider applying the Human Conservational Model, writes Jim Marous. This includes:

- Anticipating what digital customers want to achieve.

- Personalizing digital experiences for individual consumers.

- Observing and responding to digital customers’ emotions.

- Providing feedback to let digital customers know they are on the right track.

- Following social norms and good design principles.

- Designing digital experiences that embody your brand.

- Applying digital learning to future interactions.

Consumers prefer to interact with people they know and trust rather than brands and they want those communications to be more responsive, convenient and personalized. When companies embrace digital strategy and programs that focus on efficiently increasing the level of person-to-person interactions, then response rates, loyalty and business metrics increase.

Connect with ReachStack

To get in touch, contact ReachStack via email at info@reachstack.com or by phone at (877) 977-8225.

Interested in adding ReachStack to your Advisor growth stack? Let us walk you through a demo.