AUM Growth

Financial Literacy is the new prospecting qualifier for Advisors.

Advisors who use Financial Literacy as way to qualify prospects & identify which clients to focus on see significant business impact. By Brendan Kenalty.

Read MoreHow to use Financial Education to build Math skills and Client relationships.

By providing Financial Education as a service for their Client’s families, Advisors are turning generational Wealth Transfer from a risk into a growth opportunity. By Brendan Kenalty.

Read MoreFinancial Education – How Advisors win the great Wealth Transfer.

By providing Financial Education as a service for their Client’s families, Advisors are turning generational Wealth Transfer from a risk into a growth opportunity. By Brendan Kenalty.

Read MoreUnleash the Impact of Financial Literacy: See the Value of Teaching Personal Finance & Investing at an Early Age

Teaching Personal Finance & Investing at an early age has tremendous benefit for individuals. See the impact Financial Education can have. By Brendan Kenalty.

Read MoreUnlocking Wealth: 4 Ways Financial Literacy Drives Personal Net Worth

See 4 practical examples of how increasing an individual’s Financial IQ directly impacts their Net Worth. By Brendan Kenalty.

Read MoreThe Power of Financial Literacy: Enhancing Client Value for Wealth Management Firms.

Here are 4 practical examples of how increasing each client’s Financial Literacy creates value for Financial Advisors. By Brendan Kenalty.

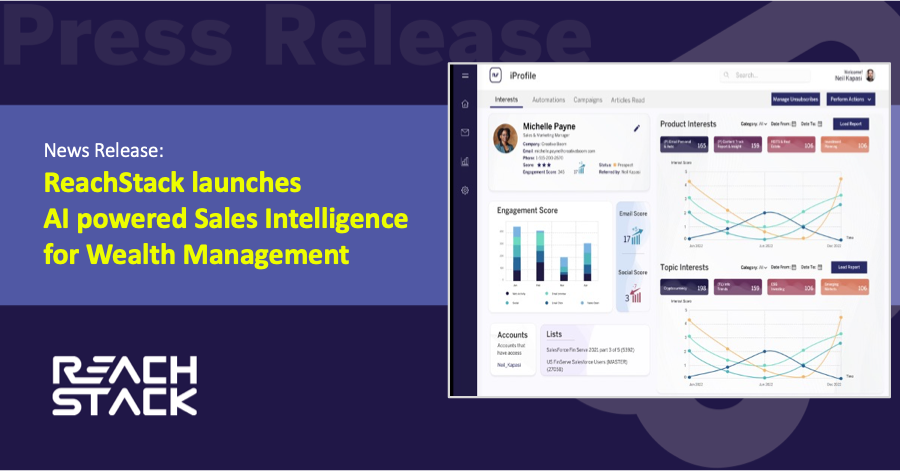

Read MoreNews Release: ReachStack launches AI powered Sales Intelligence for Wealth Management

News Release: ReachStack launches AI powered Sales Intelligence fas AUM growth tool for Wealth Management firms

Read MoreFinancial Advisor Client communication has big impact new studies show.

A must read for Financial Advisors. See 4 key takeaways from new studies by YCharts and Smart Asset on impact of Client communication in Wealth Management. It turns out communication has BIG impact on a Financial Advisor’s business.

Read MoreClient Data Is Now Prospecting Gold For Advisors.

Financial Advisors who have more relevant information about prospect needs and interests are winning new clients faster and more efficiently. They know what products & services people are interested in, then use this information to educate, reassure and nurture Client relationships. Find out more.

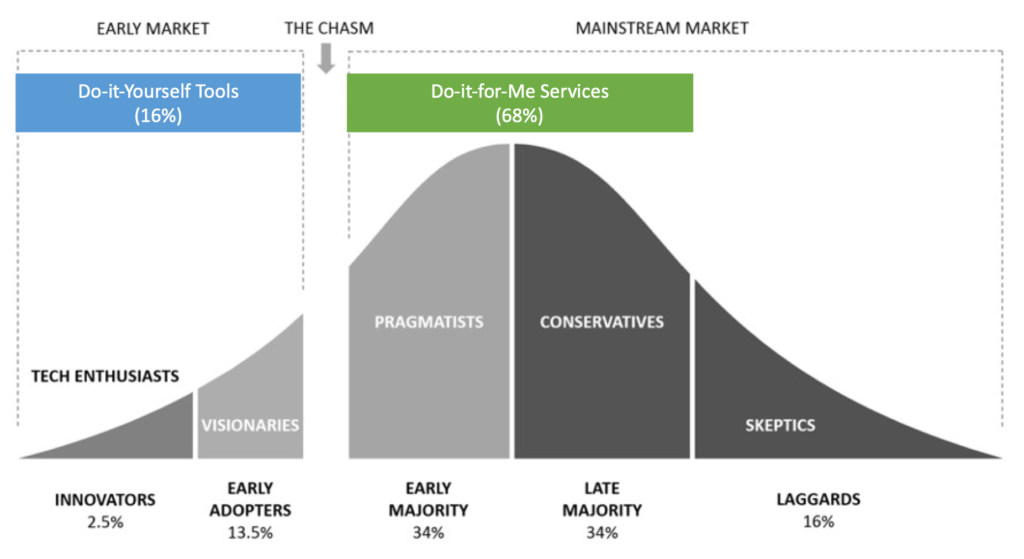

Read MoreFinancial Advisors Rejoice As Digital Shifts To Done-for-Me Service.

80% of Financial Advisors are set to rejoice, as Digital Marketing shifts from Do-it-Yourself to Done-for-Me service in 2023.

Read More