5 Steps To Choose Best Email Solution For Your Wealth Firm’s Financial Advisors

Your Advisors have been asking for help increasing the level of communication & content sharing with clients. Question becomes which is the best solution for your firm. Which will drive the most business impact, advisor participation and client satisfaction, while being the easiest to test, implement and operate ongoing.

Client communication expectations have quickly changed, so Wealth Management firms are scrambling to find the best solution to help their Advisors adapt, compete and grow.

Evaluating new technology can be challenging and time consuming, so to help make it faster and easier we have put together a simple 5 step evaluation process for selecting best Advisor Email and Client communication based on successful programs we see. Process is designed to help any Financial Services or Wealth Management firm understand what they need, and which solution is best for their specific structure and business objectives.

5 Step Advisor Email Evaluation process for your Firm to follow.

Here are the 5 steps. Below is a detailed breakdown of each step, with some tools and templates to help make your process easier.

Note: We suggest firms pilot top two solutions for head-to-head, real world performance comparison, but some firms decide that one is sufficient to understand potential impact of an Advisor Email program.

- Confirm Business Success Metrics for your Firm

- Select 2 solutions that best Impact Success Metrics for your Firm

- Get Stakeholder alignment to pilot 2 top solutions

- Run Pilots with your Financial Advisors

- Evaluate Pilot results and rollout Winning solution

Note: We suggest firms pilot top two solutions for head-to-head, real world performance comparison, but some firms decide that one is sufficient to understand potential impact of an Advisor Email program.

Step 1. Confirm Business Success Metrics for your Firm.

First, and most important step for evaluation any new technology investment, is to clearly define what the desired outcome of this program is for your key stakeholders. Who are they? What do they care about? What success metrics will they like to see reporting on?

In the case of an Advisor email and communication program, based on successful programs we see with broad support across their firms, we would suggest scorecard along these lines.

| Firm Success Metrics | Advisor Success Metrics | Client Success Metrics |

|---|---|---|

| Revenue Impact (Lift vs Baseline) | % Advisor Participation | # of Advisor communications delivered (per Yr) |

| Licensing Cost (per Advisor) | # of Revenue Opportunities Identified | # of Content interactions (per Yr) |

| Ease of Technology Integration ( Low to High) | # of Revenue Opportunities Actioned | Satisfaction survey score (NPS | CSAT) |

| Level of Marketing Support Required (# Hrs / Mth) | # of Referrals Generated |

This is fairly robust list, so we’d suggest to start by choosing a few of the metrics most relevant for your firm.

Step 2. Chose the 2 solutions that best deliver the required Success Metrics for your Firm.

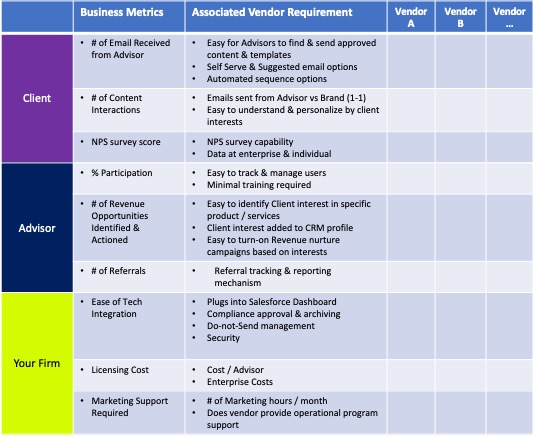

Once you confirmed your success metrics, it’s time to evaluate each vendor’s ability to deliver impact against those metrics. Below is a grid we put together to help translate the potential business metrics into types of capabilities you will require in a solution.

We recommend booking demos with each potential technology partner, then evaluating their solution vs the capabilities you will need to deliver a success program.

Note: If you need to do a more formal RFP type evaluation, please let us know and we’ll send a template to help.

Step 3. Get Stakeholder alignment to pilot 2 solutions you chose.

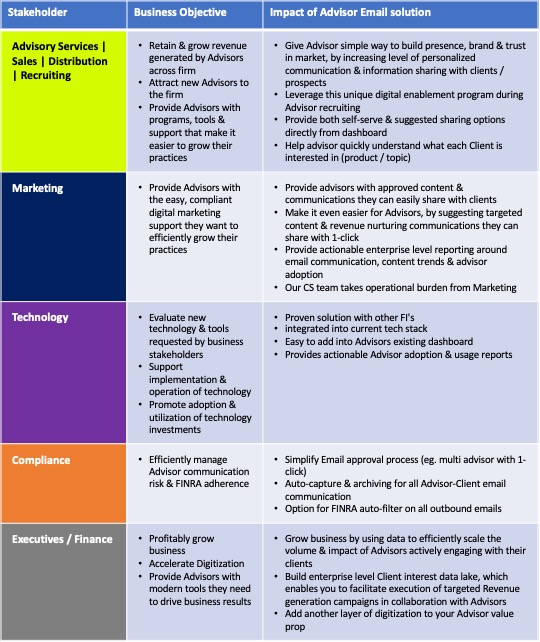

Once you select the vendors you want to test at your firm, it’s important to get key stakeholder groups on board with the plan to run a pilot and evaluate impact on everyone’s desired business metrics.

We’ve found best approach getting alignment is to highlight the specific impact and business benefits of an Advisor email solution for each of the groups.

Below is a matrix we pulled together from discussions across the industry, showing potential objectives and impact for each of the key stakeholder groups. If you were to required to build a business case, this could be the framework for it.

Note: If you do need to build a business case, let us know and we’ll provide a template work from.

Step 4. Run pilots with your Financial Advisors

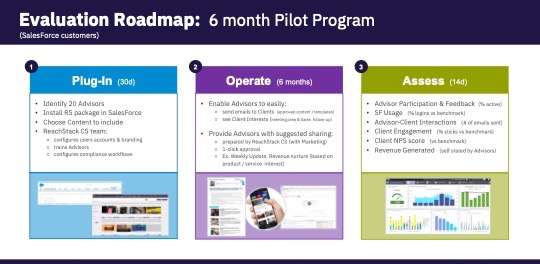

Once all the stakeholders are in the boat with you, next step is to put together a pilot program with group of Advisors interested in seeing the impact an enhanced communication & nurturing program will have.

We recommend recruiting 20-25 advisors for 6 month pilot to start, a big enough group to illustrate results while still being able to provide 1-1 support if required. Given the nature of the Wealth Management sales cycle 6 months is the minimum time we recommend to see potential business impact.

As part of the setup, plug the email platform into your Salesforce (or other CRM) and provide access to the users so they can access the content library, email templates, lists and client interest profiles right from their dashboard.

Here is a sample pilot template:

Step 5. Evaluate pilot results and roll-out winning solution to all Advisors

Once the pilots are complete the hard part is done. Now comes the fun part of preparing a scorecard to see the results for each solution vs your success metrics, deciding what worked best and communicating your results to organization.

We’d recommend developing a simple 1 page scorecard to illustrate the key results to each stakeholder.

Something that helps show the lift in the key metrics Firm, Advisor & Client metrics. Beyond the Success Metrics established at the beginning of process, we recommend included a few other things to help secure full program budget:

- Insights on potential Revenue opportunities (what products / services were clients most interest in)

- Advisor testimonials / quotes about how much it helped them (understand / engage / grow)

- Content insights (what topics, types of content were clietns most interested in, what should you do more / less of)

Well enough talking, it’s time for you to get to it. Good luck and please let us know if anything we can do to help make your process easier. Free free to contact us anytime info@reachstack.com

About ReachStack

ReachStack is an intelligent email platform for the Financial Services industry. ReachStack’s data driven, personalized content sharing technology makes it easy for all users across an organization to better understand and action each of their prospects/client’s interests, leading to increased satisfaction, referrals and demand for new services. For more information on ReachStack please visit ReachStack.com. To understand potential results at your firm please download our FREE business case.