Raising America’s Financial IQ will grow our Wealth Industry, so let’s give FAs a free AI powered service that makes it easier to educate clients

Reprint of Linkedin article

By Brendan Kenalty | MBA | CMO

———-

Imagine the revenue impact for Wealth Management industry of having every American more knowledgeable about their financial situation, and increasing their level of participation.

Let’s start with the premise that most Americans would like to improve their financial situation, and that having a core level of financial knowledge is a key enabler of that change.

A few factoids to frame-up the discussion:

- <20% of Americans have solid level of Financial Literacy (TIAA study)

- <55% of Americans invest (Gallup study)

- average Financial Advisor (FA) shares information with Clients <4x a year (Dalbar study)

- 86% of FA’s want to share more information with Clients, but say they need help to do it (RS study)

The average Americans does not understand the basic concepts around personal finance and investing. They are unaware of the basic knowledge that enables the wealthy to leverage this information to their benefit. Our Wealth Management industry wants to help, but doesn’t current have the tools to make the process efficient at scale.

Having all Americans educated and participating in the Wealth Management industry is a significant opportunity for Revenue growth.

The Content to educate every American on personal finance already exists.

Now let’s look at the opportunity to impact this. The library of educational information required to close this gap already exists. It is being updated everyday by Asset Management firms and other parties with the single goal of explaining how their products and services help people improve their financial situation.

Our industry includes some of the most brilliant people on the planet, who produce volumes of insights, updates and ideas on how to improve your financial situation.

Imagine establishing a curriculum of financial knowledge that every American should know, then developing a program that ensures every person gets educated on every topic at their own pace, as they move through their life.

Challenge is providing each American with right “help” at right time.

Effective financial education happens slowly over time by focusing on benefits to each individual. What’s in this for me? How is learning this going to help me?

Taking a long term view of dripping out engaging, relevant and benefit focused information across all digital touchpoints, using the range of content formats and styles that naturally draws people into learning as they move through their life.

Education can also be driven by situational need. Something has happened and they to figure out what to do. In those cases, it’s an opportunity for an Advisor and Asset Management firm to build tremendous credibility and goodwill, by proactively understanding a person’s situation, then providing the knowledge and advice for best course of action. Being present and helpful, when someone didn’t expect it.

Helping people is specific situational context is key. Delivering relevant knowledge & simple educational material, in snack-sized chunks, when and where they need it is a much more impactful way to educate. Helping people when they really need it, building the credibility of the Advisor and Understanding when people are in a certain situation,

Using the wealth of digital behaviour data that now exists, we are able to understand exactly what products and topics individuals are interested in, or situation they are trying to solve for.

Using AI powered content matching, we can automatically help Advisors personalize and share the most relevant, high quality educational material from across the industry, directly to people when and where they need it.

This could include putting people on a general Financial IQ communication sequence, or delivering education sequence on specific topic identified.

Opportunity to give RIA’s an AI powered Financial Education & Revenue Nurturing service

People with the knowledge to understand the benefits of a product or service, are more confident, trusting and likely to buy. Financial education primes the pump for Advisor & Asset Manager revenue growth by nurturing the demand for variety of products and services.

So what if we got together and provided this Financial Education & Revenue Nurturing service for free to Advisors? It’s a win for all parties. Clients have bigger appetite for services, Advisors are trusted heros by proactively educating and solving problems, and increased AUM flowing into system means Asset Managers have more demand for their products and services.

Free drives Advisor scale required to impact the industry.

People love free, especially free with clear benefit. Advisors today are paying $50-250 per month for basic digital content sharing and email services. This would be much more strategic, simple and impactful to their businesses.

By providing a free, compliant, Client education & nurturing service that easily plugs into any firm or Broker Dealer’s (BD) tech stack, with transparent enterprise level reporting, will help get us the BD endorsement’s and support required to scale impact across industry.

So who could fund this? What’s it worth to Asset Management companies for a channel that demonstrates their knowledge and value to potentially thousands of Advisors and millions of investors. As the biggest beneficiary with arguably the largest marketing budgets, would Asset Managers fund this? Building a direct communication channel with their potential market of Advisors & Clients. They build brand awareness and credibility as trusted educator, increase distribution and ROI on their content investments, and get tons of data on what topics and products people are interested in.

Fintech and digital trading platforms are already doing this. Today’s opportunity is to provide way for RIA’s to better compete by leveraging same technology and approach.

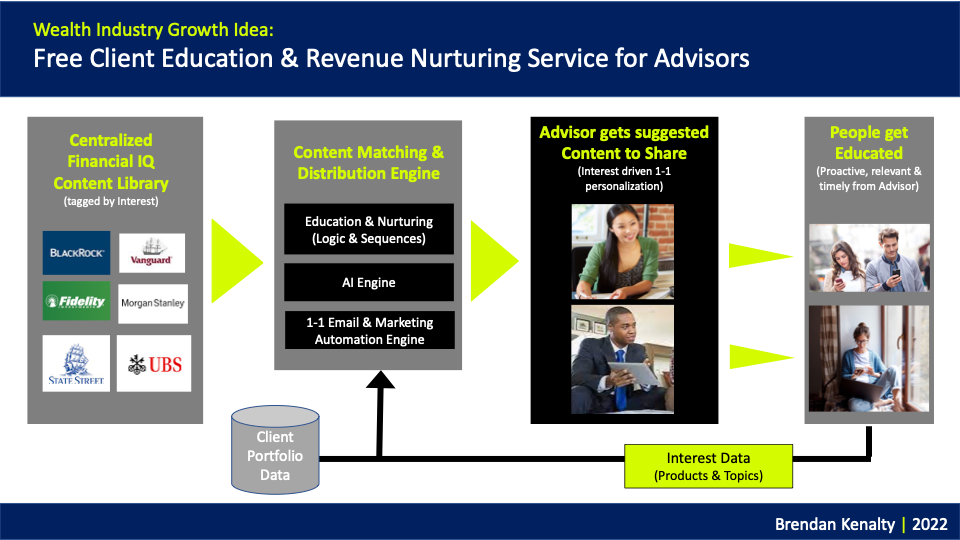

How free Financial Education & Revenue Nurturing service could work.

Below is illustration of how this service could work.

Advisors can plug service into Salesforce or other dashboard to easily add all their contacts. Every content interaction is tracked so they see each Client’s product & topics of interest right in person’s CRM profile. Great for meeting prep or identifying next best revenue opportunity.

Financial education content is pulled into a central Content Library from wide range of Asset Management companies and other sources. All the content is tagged with appropriate topic, product and other parameters.

The system uses an AI engine to compare each contact’s financial interest profile, then find articles and sequences from the Content Library that match their situation, behaviour and potential gaps in their personal financial knowledge.

Content is then assembled and sent to each Advisor to quickly review and approve before they get sent out. Advisors can also turn on automated educational sequences for individuals and like-minded groups based on data in individuals interest profile.

We could start the Education process today.

We have all the parts to start doing this today. We have the content from Asset Managers like Blackrock and Vanguard , the AI powered digital sharing technology from companies like ReachStack, Client management platforms like Envestnet, CRM’s like Salesforce, and appetite from Advisor at innovative, client focused Advisory firms like Edelman.

Let’s hear your thoughts. Is it a good idea? Can we put this service together? Would you like to be involved? Please reach out to comment or discuss.

About ReachStack

ReachStack is an intelligent email platform for the Financial Services industry. ReachStack’s data driven, personalized content sharing technology makes it easy for all users across an organization to better understand and action each of their prospects/client’s interests, leading to increased satisfaction, referrals and demand for new services. For more information on ReachStack please visit ReachStack.com. To understand potential results at your firm please download our FREE business case.