Three Studies Showing Clients Want More Communication

Research: 3 Studies show Clients want more communication from their Advisor

By Brendan Kenalty | MBA | CMO

________

Given the connected, information hungry nature of people of all ages now, we’ve pulled together some rather shocking research on state of Advisor Client communication in 2020:

- 64% of Clients hear from their Advisor less then 4x a year

- 50% of Clients did not hear from their Advisor in first 3 months of Pandemic

- Yet 85% of Clients say Advisor communications impact retention & referrals

In this report we’ve analyzed 3 recent studies to understand the growing gap between expectations of today’s Wealth clients, and the “couple of times a year” communication approach of most Advisors.

2020 highlighted the gap in Advisor communication

2020 was a scary year for a lot of people, and in nervous times we all seek information from trusted sources.

People’s uncertainty on impact to their financial situation put pressure on financial advisors by clients and competitors, to be more visible and proactive in their communication, reassurance and guidance or lose their status as the go-to resource and trusted advisor.

While the uncertainty of 2020 drove a big spike in demand for more Advisor Client interaction, this need for more frequent personalized 1-1 communication has been a growing trend for last 10 years. The rise of digital, social and mobile channels have fundamentally changed everyone’s expectations. Clients of all ages now choose to get frequent, personalized information automatically sent directly to their phone by friends, business associates and digital entities 24/7. They want the same level of information and advice on their finances, and if their Advisor isn’t providing it, they are signing up for their competitors.

Advisors can’t expect to be the sole source of financial information, but they need to be active and present in the feed. Recent studies reinforce that Advisors who breakout of the traditional “couple of times a year” communication approach with Clients, not only differentiate themselves, but improve client satisfaction and growth through referrals.

Recent data from our ReachStack platform illustrates that our while our Advisors have increased their communication frequency to more then once a week, their client engagement and satisfaction results have never been higher.

You don’t have to take our word for it. Below are the findings from 3 studies illustrating the growing demand for Advisors to adapt to the new Client communication expectations or put their practice at risk to a range of competitors.

Study #1: YCharts Advisor-Client Communication Report featured by Michael Kitces March 2020

Sean Brown, CEO of YCharts, shared learnings from recent Advisor Client Communication study of 650 users of Financial Advisors on Michael Kitces Nerd’s Eye View Blog.

“An advisor’s ultimate value-add is to help clients achieve their financial goals, while helping to relieve the stresses and concerns brought on by money and an uncertain future. How can clients be guided to think, “My advisor’s got it covered,” whenever a question or concern pops into their head? To stay top-of-mind, reinforce to clients the value you provide, and build stronger relationships, frequent and consistent communication is a necessity.”

Sean Brown, CEO @ YCharts

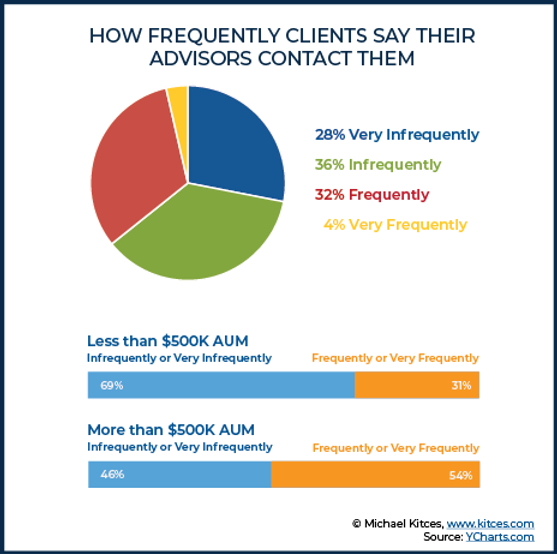

Insight #1: 64% of Clients DON’T hear from Advisor.

It’s crazy to think that 64% of clients aren’t receiving updates on their financial status, or getting the opportunity for personalized advice they are paying for.

Given today’s growing number of competitive options for Financial Advice and investment, it’s amazing this type of behaviour is still happening.

The bull market of the last 10 years might have helped Advisors survive this level of service, but as the inevitable market slow down occurs the many competitors who have used technology & automation programs to educate, communicate and build deep relationships with your clients during this period, are well positioned to take over as their trusted advisor.

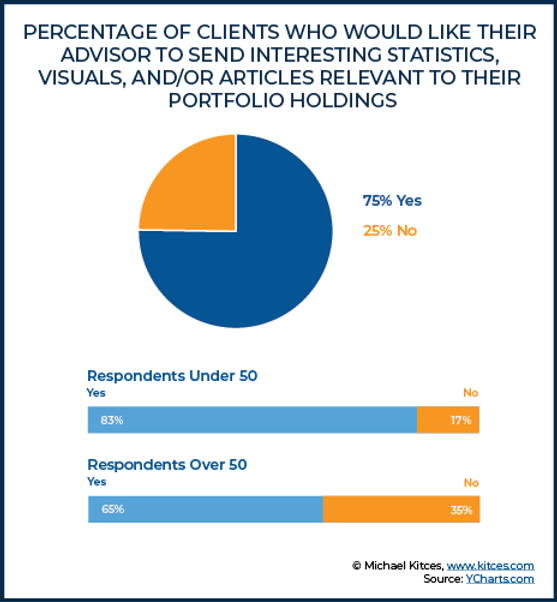

Insight #2: 75% of Clients want MORE personalized communication

Given that 75% of Clients want more personalized content sent to them, this is a great way to also satisfy the 64% of Client’s not hearing from them.

It’s time for Advisors to leverage the same automation and personalization technology, their new digital competitors use to understand their client’s interests and needs, then efficiently deliver proactive, personalized information directly to their phone at whatever frequency they each prefer.

Imagine the surprise of existing client start seeing there Advisor’s name show up in email fee everyday, delivering high value personalized information to them.

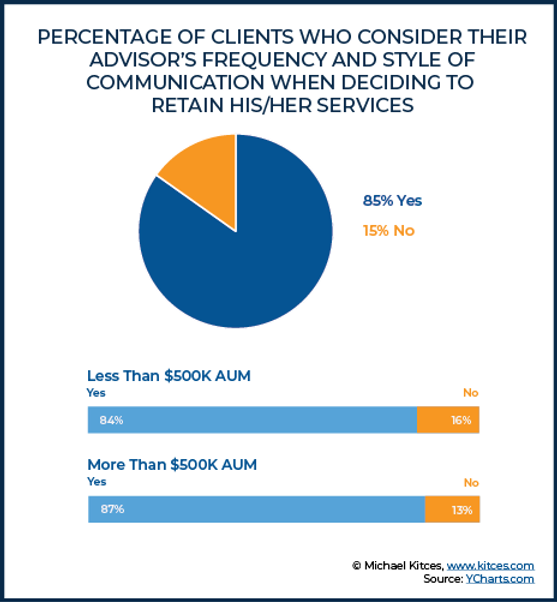

Insight #3: For 85% of Advisors communication impacts AUM

For 85% of clients the frequency and style of their Advisor’s communications is important to them impacting both the likeness to retain and refer their services.

An Advisor’s communications indicate several things to a Client:

- How important they are to the Advisor?

- How knowledgeable is the Advisor?

- How much time does the Advisor spend thinking about them?

In the short term poor communication may only result in a dissatisfied client, but in the long term these client have a big impact on an Advisor’s business by leaving or eliminating referrals, the #1 source of new business for most Advisors.

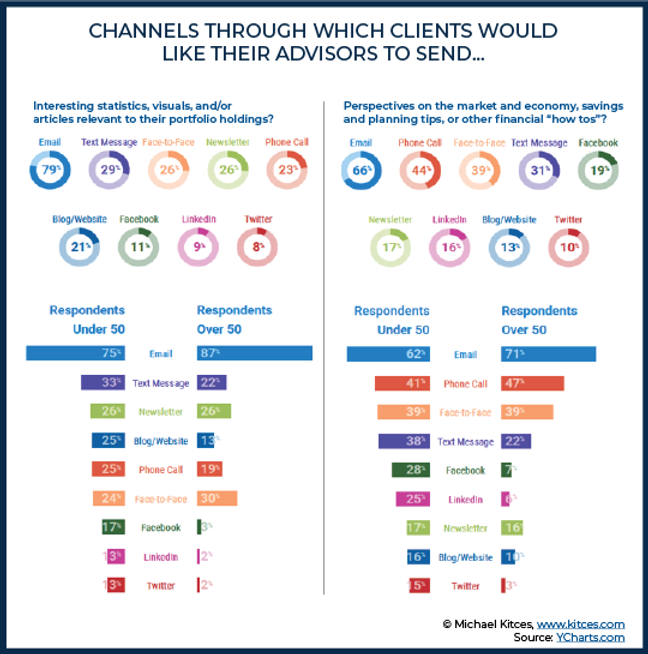

Insight #4: 79% provide Email growth opportunity

For clients of all ages, email is still the prefered channel for communicating with their Advisor. It’s 1-1, private, easily accessible from any device and most importanctly makes record keeping easy by automatically storing a copy of the discussion.

Again we’re surprised more Advisors don’t take advantage of the highly cost effective, modern Email platforms which use analyics and AI to easily allow them to automate the sourcing, personalization and sending of 1-1 communications on a daily basis.

Some of the newer platforms like ReachStack, also include prospecting efficiency tools that have robust client profiling, reporting and Next-Best Revenue opportunity identified for Advisors based on client interests and behavioural tracking.

Study #2: J.D Power Report featured in Financial Advisor Magazine July 2020

Mike Foy, director of Wealth and Lending Intelligence at J.D. Power and author of the study, said that if advisors had only acted proactively back in February, they might not now be facing the loss of established clients and their assets.

“It may seem intuitive now, but advisors that were vigilant in March and April are far better positioned to reap the rewards in client retention, loyalty, and referrals in coming months, and as the landscape in a post-pandemic world continues to evolve, the advisors that are nimble and more willing to adapt to prioritize their client’s changing needs and preferences are far more likely to enjoy these spoils in the future as well.”

Mike Foy, Director of Wealth Intelligence @ J.D. Power

Insight: Clients Complain of AWOL Advisors During Pandemic

Traditionally many Advisors have subscribed to the 80/20 rule, focusing 80% of their time on the top 20% of their clients. Unfortunately with increased level of competition in market, that’s putting 80% of their clients at risk of being better serviced by expanding list of competitive options, including do-it-yourself.

A couple of facts jumped out at me from the recent J.D. Power study of 521 retail investors in June 2020. Really drives this point home:

- 50% of Clients did not hear from their Advisor in 3 months since crisis started

- 28% heard from Advisor at least once, only 18% heard

- 55% use Email to contact Advisors (#1 digital channel)

Study #3: DALBAR Investment Research Firm survey of 995 investors in August 2020

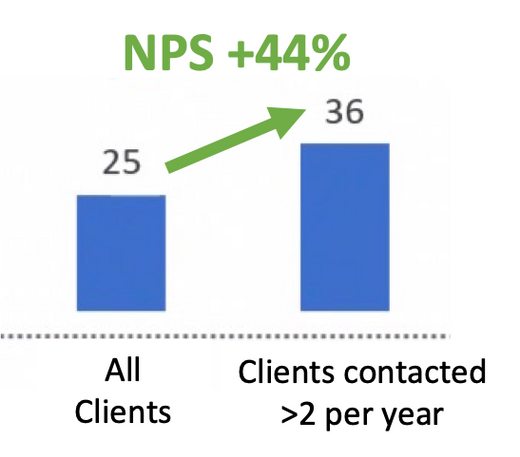

Insight #1: Advisors who send frequent, proactive communication have higher Client satisfaction (NPS)

DALBAR study found that investors who receive frequent, proactive communication from their advisor show much higher satisfaction scores than those who did not.

Other industry data is supporting this approach. A leading wealth management firm shared their findings from recent internal study showing clients who receive >3 communications a year from their Advisors have Net Promoter Score (NPS) 44 points higher then clients receiving 3 or less. As a side note, this firm is now working with ReachStack to increase Advisor Client interactions.

DALBAR also found robo advisers are more likely than traditional advisers to contact clients each month, leading to a higher feelings of proactivity and timely support by Clients.

Insight #2: 47% of Clients did not hear from Advisor during crisis

Fifty-three percent of respondents reported that their advisor had contacted them during the worst of the crisis at the time they needed it most, while 47% said their advisor had not communicated with them during the crisis when they needed it most — or failed to get in touch at all. 53% of investors in the survey said they had received proactive communication from their advisor during the market crisis.

Of the investors reporting they received a communication, 80% received an email, 50% a phone call and 33% a text message.

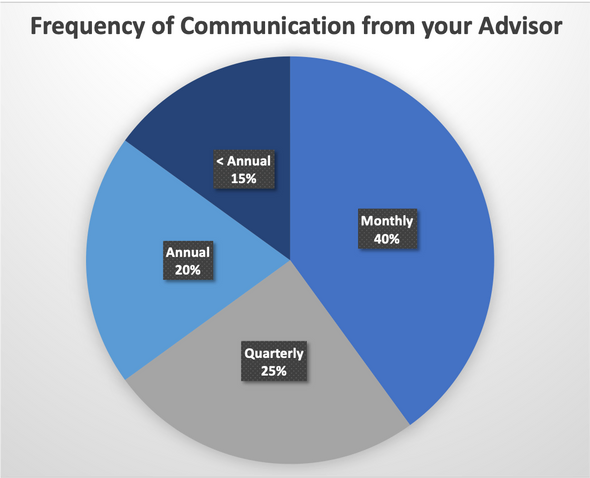

Insight #3: 60% of Clients get less then 4 communications a year

This is shocking in today’s environment given the volume of information clients are receiving on a regular basis about subjects far less important to them then their FInancial health.

Data from a survey prior to the onset of the crisis:

- 40% of Clients said they received monthly communication from their advisor

- 25% reported quarterly

- 20% said annual communication

- 15% said they heard from their Advisor less then once a year. WOW!

Sources for information in this post:

- ReachStack platform statistics : iTracMarketer (2021)

- EY Global Wealth Mgmt Report (2019)

- Financial Advisor Magazine : J.D. Power Wealth Management Insight Report (2020)

- Dalbar Financial Services Survey (2020)

- Michael Kitces blog : YCharts.com Communication Study of Wealth Clients (2020)

About ReachStack

ReachStack is an enterprise level personalization & automation platform for Advisor-Client communications. Our “do-it-for-me” approach results in 70% advisor adoption vs 10% for most “do-it-yourself” tools. Make it easy for your Advisors to increase visibility, satisfaction & referrals by ensuring they are part of each client’s daily financial conversations and information feeds. Easily scale Advisor-Client interactions across your firm from 4 to 100x a year, by helping Advisors deliver up to 20 personalized, sharable Client interactions a month in only 5 minutes a day. Increase Advisor prospecting efficiency by profiling each Client’s interests and needs, then providing a weekly “hot list” for easy Advisor follow up.

For more information please Book a Demo

Or contact us. | info@reachstack.com | 1.877.977.8225