Advisors Who Send More Emails To Clients Get More Engagement.

Engaging Financial Advisors

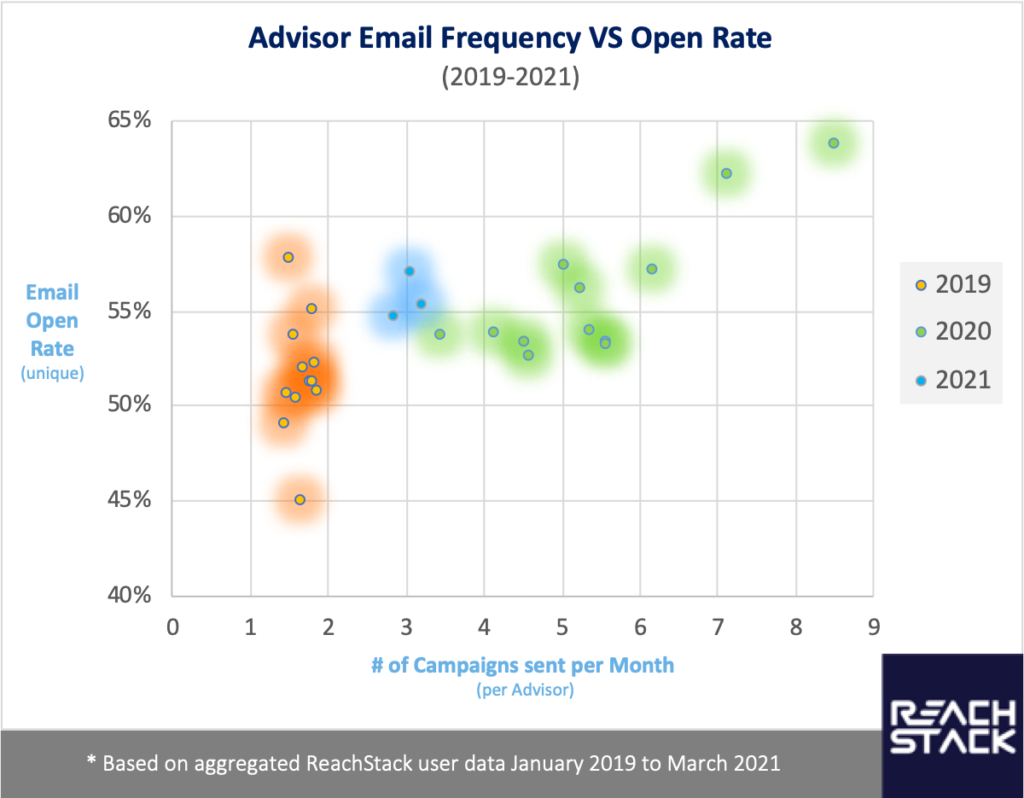

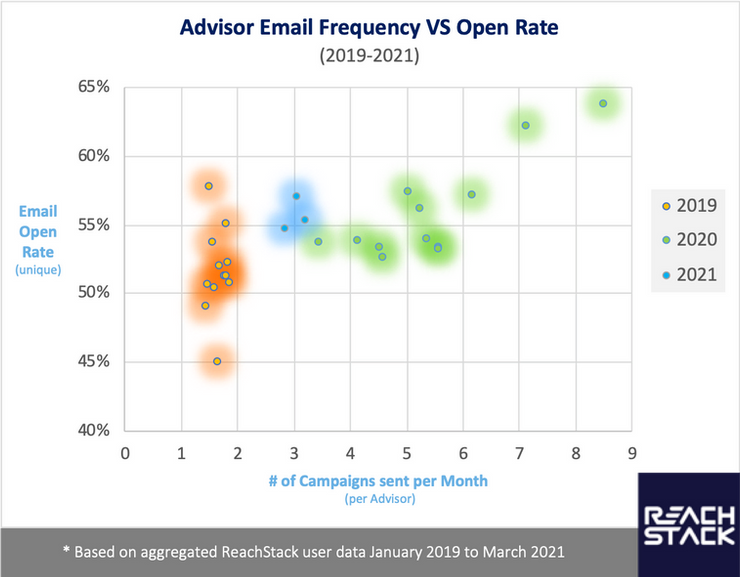

The frequency of advisor-client communications is rising – and this is good news. New data analysis shows that increasing the frequency of emails sent by advisors actually increases the clients’ open-rate of those messages by almost 20 percent.

ReachStack compiled and analyzed the data from our platform going back over the past 27 months for over a thousand advisor users. As advisors increased the frequency of email communications from once per week to twice a week, open rates for those messages increased as well.

The pandemic is likely one factor contributing to this increase in communication. Clients have been concerned about markets and increased volatility while, at the same time, public health restrictions have curtailed traditional in-person meetings between advisors and clients. To fill the gap, advisors have adopted video conferencing for virtual meetings with clients and also increased the frequency of all kinds of digital communications, including email.

According to a recent survey by SmartAsset, the number of advisors reporting only quarterly communications with clients dropped from 69 percent before the pandemic to 39 percent now. At the same time, advisor reporting monthly and/or weekly communications with clients has virtually doubled.

This trend to more frequent advisor-client communication is not only about the pandemic – and it won’t disappear when the pandemic recedes. The reality is that clients are being bombarded with financial information, data and advice on a daily basis and advisors are facing increased competition for their clients’ attention in this environment.

Financial Information and Advice are Everywhere

It can seem like everyone is talking to your clients about their investments these days. Financial media analysts and commentators create a daily stream of reporting and content aimed at investors. Social media platforms, especially newer ones like TikTok, are seeing an explosion of creators dispensing financial and investing advice (much of it not very good). And rapidly evolving cryptocurrency markets are getting lots of mainstream media and social media coverage. Your clients might even be having conversations about the new world of digital currency with their crypto-curious teenagers!

Every day, your clients face a barrage of financial information and informal advice from every source imaginable – except you, the advisor, the person in whom your client has entrusted their financial future.

Three-quarters of clients surveyed want to see more frequent and personalized communications from their advisors. See: Research: 3 Studies show Clients want more communication from their Advisor.

This is a problem and it’s causing a growing gap between your clients’ expectations around the communications, insight and advice they receive from their financial advisors and your ability to efficiently meet these expectations.

How Much is Too Much Information?

One challenge facing the wealth advisory industry is that it has spent much of the past several decades telling clients to ignore the financial media and not to be lured into market timing or trendy investment strategies. Increasingly, advisors are developing financial plans for clients based on their risk tolerance and fundamental investment principles and then asking clients to trust them in implementing the plan and not be swayed by every upward tick or downward tumble reported in the financial media.

In principle, this is a good strategy. However, the world is changing and our inboxes and social feeds are increasingly filled with communications about our financial lives. It is harder than ever for advisors to stay visible and top of mind with an annual face-to-face meeting, a quarterly report and the odd phone call with clients.

Some advisors worry that too much email could be an annoyance to their clients prompting them to unsubscribe or opt out of regular communications. However, we’ve seen little evidence of this in the data. Clients rarely opt out of communications from their advisor because of the nature of the relationship. Clients may choose to ignore content or reach out to the advisor directly to provide feedback.

In the contemporary digital world, building trust relies on being consistently visible and adding value, being proactively part of the conversation your client is having about their future, and demonstrating why your clients should trust you rather than just telling them to trust you. In addition to higher engagement rates, some ReachStack customers have reported higher Net Promoter Scores being correlated to the increased frequency of communication.

However, the reality is that 70 percent of advisors cannot achieve this increased rate of communication on their own – they are already swamped. Advisors need to find ways to increase the frequency of communications and sharing with clients. They don’t want more DIY tools – they want their marketing team (or someone) to provide services that reduce the effort for them.

About ReachStack

ReachStack is an enterprise level personalization and automation platform for advisor-client communications. Our “do-it-for-me” approach results in 70 percent advisor adoption vs. 10 percent adoption for most “do-it-yourself” tools. Easily scale advisor-client interactions across your firm from 4 to 100x a year, by helping Advisors deliver up to 20 personalized, sharable client interactions a month in only 5 minutes a day.

For more information please book a demo or contact us info@reachstack.com or 1-877-977-8225.